Supply issues continue to hamper the manufacturing of key models.

An ongoing global semiconductor shortage is continuing to impact vehicle production.

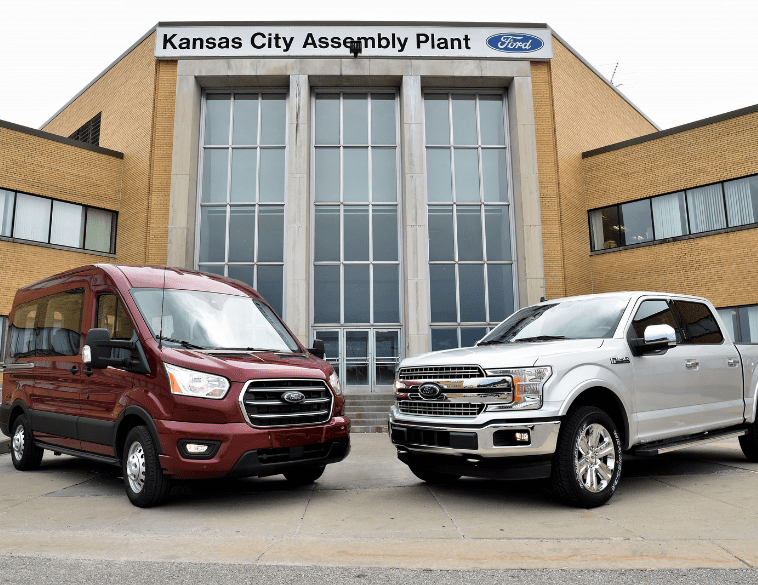

Here in North America, Ford Motor Company recently announced that two of its idled manufacturing facilities, Chicago and Kansas City, will see shutdowns extended, at least through the first two weeks of May.

Additionally, in Canada, Ford will also suspend production at its Oakville Assembly complex early in May. Oakville currently produces the Ford Edge and Lincoln Nautilus crossover utilities.

Limited capacity

Other facilities, such as its Dearborn truck plant in Dearborn, Mich., and its heavy-duty truck manufacturing facility near Cleveland, will only be producing vehicles in limited capacity through May.

The semiconductor shortage has been a major disruptor for U.S. headquartered OEMs since it has severely impacted the production of some of their most profitable models. Back in February, Ford said it could lose between $1 billion and $2.5 billion in operating profit this year as a result of the chip shortage.

Across town, Ford’s rival General Motors has had to cut or suspend production in at least six of its manufacturing facilities, though at present has still managed to continue manufacture of its profitable full-size pickups and SUVs without idling the plants that produce them. Other automakers severely impacted by the semiconductor shortage include Stellantis, Toyota and Volkswagen.

According to Bloomberg, the onset of the COVID-19 pandemic triggered an explosion in demand for consumer electronics, notably smartphones, tablets and personal computing devices which fueled the current semiconductor shortage.

Inventory issues

In the automotive sector, a reduction in microchip orders in 2020 due to an anticipated (and prolonged) lull in new vehicle sales, combined with an increasing over-reliance on semiconductor chips for ever-more advanced vehicle features has exacerbated the problem.

According to data from IHS, Deloitte analysis, electronic components have zoomed from around 18% of total vehicle cost in 2000 to 40% today. These numbers are expected to reach 45% by 2030.

The biggest shortage in semiconductor chips is, according to many industry experts, centred around 200 mm wafers. These wafers are used to create lower-end microchips that are found in many integrated circuits and popular consumer items. Items ranging from cars to electronic devices such as graphics cards, gaming consoles, smartphones and home appliances.

Global supply chain fragility, which has been exposed and amplified by the pandemic, plus the fact that the majority of the world’s microchips are sourced from just two manufacturers, Taiwan Semiconductor Manufacturing Co., and Samsung Electronics Co. has only exacerbated the problem.

Rising manufacturing costs associated with semiconductor chips over the last decade have also made it increasingly harder to expand production capacity to keep up with demand.

More pressure

With the rollout of 5G and the world focused on creating the Internet of Things and other advanced communication and interconnectivity devices, demand for semiconductor chips is expected to skyrocket, putting even more pressure on demand.

Although it is difficult to say just how long the semiconductor shortage will last, many are predicting the crisis could continue through the remainder of 2021, which could cost the auto industry tens of billions of dollars.