For dealers, the COVID-19 pandemic has created an almost extraordinary set of circumstances.

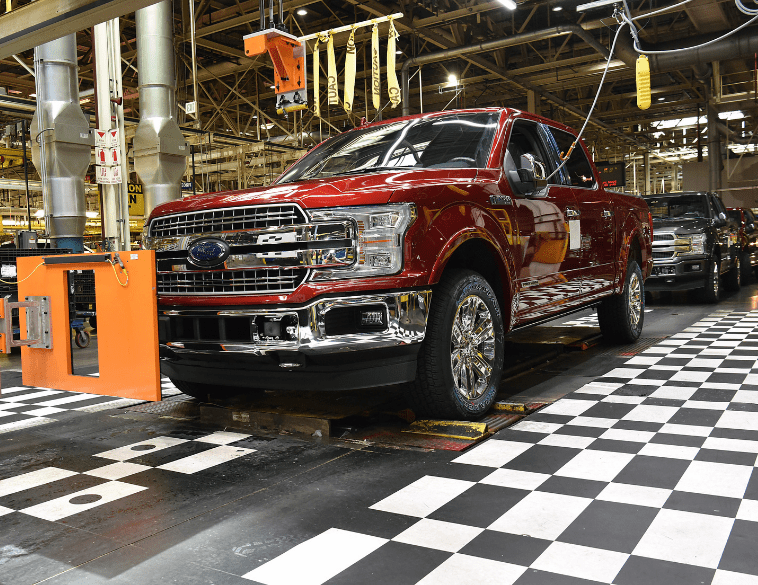

A shortage of new vehicle supply stemming from manufacturing shutdowns early during the pandemic in 2020 has created a scarcity of new vehicles available over the last several months.

Virtually every OEM has been impacted with the result that dealers have struggled to get new vehicle inventory out and when they do, they are often snapped up by eager buyers with cash to spend as a result of rock-bottom interest rates and pent up cash resulting from stay-at-home orders.

Added pressure

With fewer new vehicles available, there’s also been added pressure on the used vehicle market.

Buyers traditionally shopping for new vehicles who have found dealer lots depleted, have instead been seeking out CPO (Certified Pre-Owned) cars and trucks. Yet, because the supply of new inventory has slowed to a trickle, what CPO vehicles have become available are being quickly turned, in some cases in as little as a few days.

This has placed added pressure on the existing supply of low-mileage, CPO quality vehicles since there simply isn’t enough to go around. Furthermore, auctions across North America are reporting record low levels of inventory and with considerable pressure on sending used cars south of the border due to a weakened Canadian dollar, it has put upward pressure on prices in all sectors of the used vehicle market.

In fact, according to data from Canadian Black Book (CBB), both wholesale and retail values for used vehicles have seen significant increases over the last several months and in March, wholesale values for both passenger cars and light trucks are reaching levels not seen since August 2020 (increases of more than 0.25% and 0.5% respectively).

In terms of individual segments, CBB reports that the biggest gains have been in light trucks, with compact crossovers seeing price increases of 1.12% between just March 14 and 19, followed by mid-size crossovers at 1%, subcompact crossovers at 0.75% and smaller pickups at 0.72%.

During the same period, prices for passenger cars have also shown healthy increases, with subcompact cars seeing a rise of 0.88%, followed by sporty cars (0.86%) and full-size cars at 0.72%.

Higher retail prices

On the retail side, average prices have continued to climb, with CBB recording that the average transaction price as of March 19 was now north of $24,860. CBB says it predicts prices to continue to climb especially as the traditional spring selling season gets underway.

To try and get around the issue, dealers are being forced to reevaluate the trade-in process and keep vehicles that normally would be wholesaled or sold privately for their inventory, choosing to have them reconditioned and retailed as used cars.

Others have turned to source vehicles through their existing service customer database, cherry-picking the lowest mileage and best maintained vehicles for resale when they come through the service drive.

Yet, as trends point to consumer demand increasing over the next several months, while inventories are expected to remain tight on both the new and used side—dealers are likely to face even greater challenges in accessing inventory, but the flipside is that when they do, the reward is higher gross margins on the cars they do acquire.

In recent weeks, the new car market has been further disrupted due to extreme weather conditions in southern U.S. states such as Texas where a number of component suppliers of products such as microchips, automotive plastics and interior components are based. This has had the net effect of adding to the already serious microchip shortage as well as limiting the ability of OEMs to actually assemble vehicles both here in North America and overseas.

Significant losses

According to a recent article in the Wall Street Journal, the semiconductor shortage has become so acute that OEMs such as General Motors could see as much as $2 billion in pre-tax profit wiped out this year, with Ford Motor Company expected to see similar losses of around $2.5 billion.

Toyota and Honda have also been forced to scale back production capacity due to ongoing component shortages.

Based on data from consulting firm Alix Partners, the global microchip shortage could lead to automakers producing between 1.5-5 million fewer vehicles in 2021, which could both significantly raise the cost of motoring for consumers as well as threaten jobs that are vital to the North American economy.