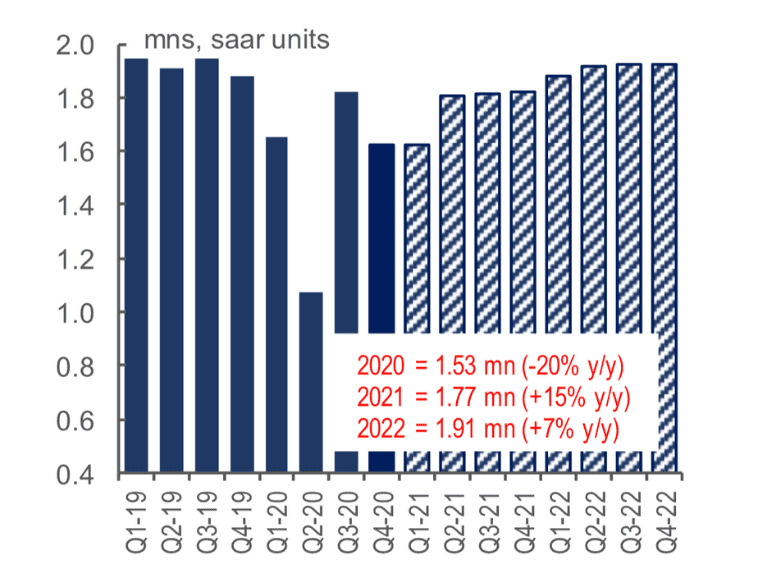

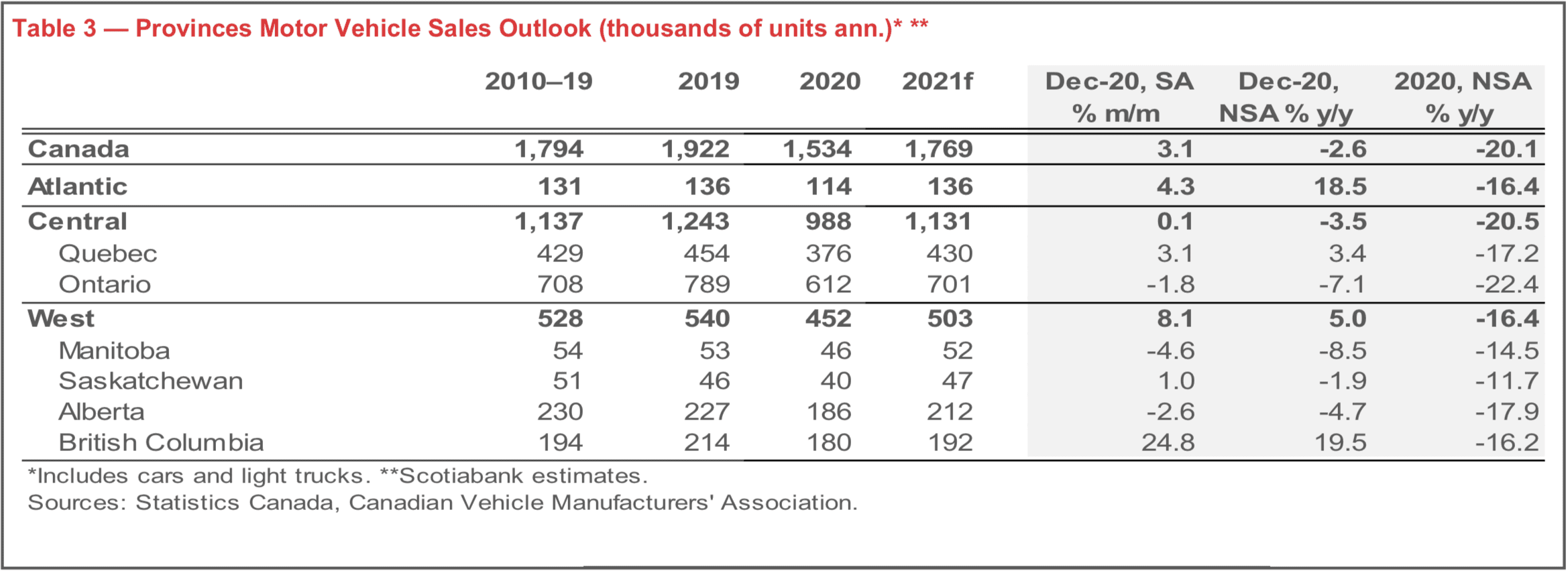

To no one’s surprise, the COVID-19 pandemic took its toll on the auto industry in 2020. Global sales dropped by 15% y/y, including a fall of 20% here at home in Canada.

Even so, it wasn’t free fall all year, but a series of drops and rebounds. In the early months of 2020, many major economies saw their auto sales fall by as much as 80% from the year before.

When things opened up after the first wave, sales rebounded at an exceptional pace, with Canada posting a 70% improvement in the third quarter. Sales began normalizing as pent-up demand was met, although Canadian sales softened as the second waves escalated.

Ups and downs

Numerous factors drove the market, including government support to households, higher disposable income – primarily because restrictions meant there wasn’t much to spend it on – and improved consumer confidence, recovering financial markets, and lower credit costs. These all fluctuated over the year, but still made enough of an impact on auto sales.

Even so, there were some headwinds, including from new-vehicle price inflation. This trended well above headline inflation for most of the year in Canada, and in December, vehicle inflation was up 2.5% y/y, versus 0.7% y/y for headline inflation.

The U.S. saw a similar trend, with J.D. Power reporting that the average vehicle price was up by about US$4,000 at the end of year relative to early-2020 prices.

Supplying the Demand

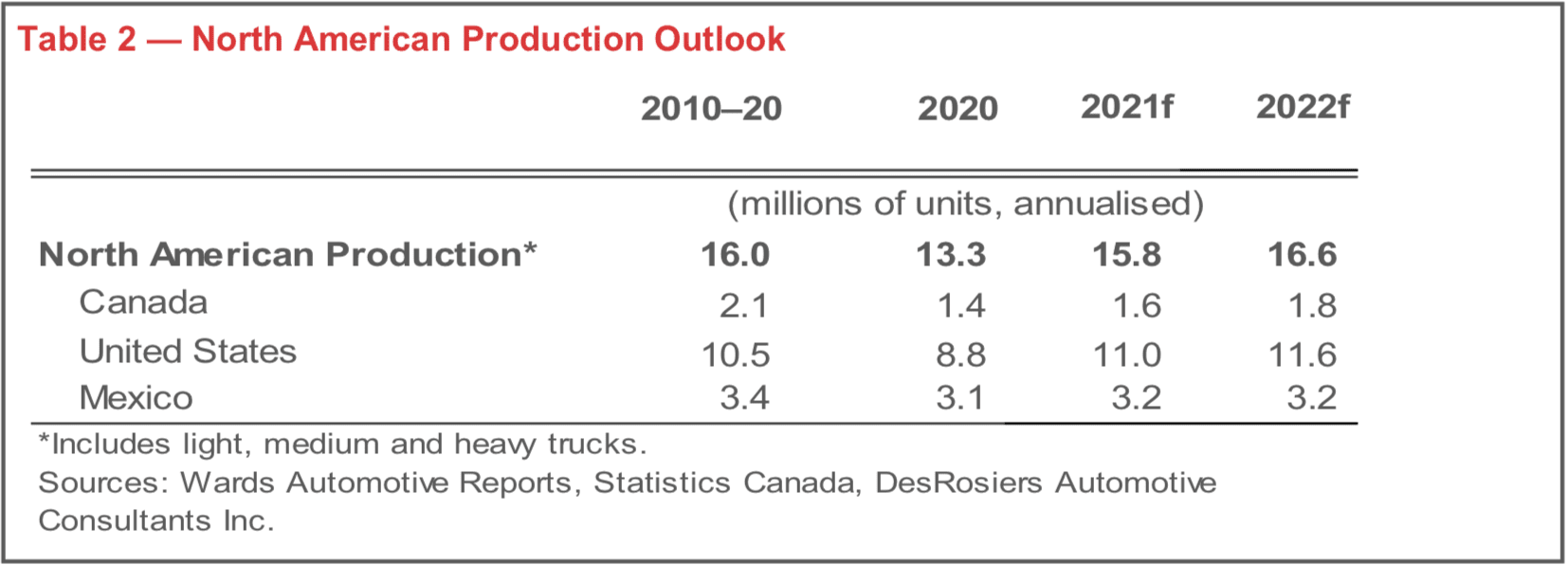

Supply also created issues, as buyers demanded more vehicles but automakers often had to stop or disrupt their production due to COVID restrictions. Currently, the inventory-to-sales ratio in the U.S. sits at a multi-year low, and these challenges are expected to continue through the first quarter of 2021 and possibly longer, since computer chips vital to auto production are in short supply.

Used-vehicle prices normally soften in economic downturns, but instead they went up, with Canadian Black Book reporting used-vehicle retained values for 2- to 6-year-old vehicles at their highest level in the history of its report at the end of the year.

As the supply of used vehicles normalizes, prices are expected to weaken, and more buyers are expected on that side of the sales lot in 2021.

Expect better times ahead

The net impact of a strong, mid-year rebound in Canadian auto sales in 2020, along with relatively resilient sales activity in the face of second waves toward year-end, provides a solid hand-off to 2021.

Throughout this year, we expected U.S. sales to improve by around 15%, and worldwide, global auto sales should strengthen by 9% y/y, driven primarily by the Chinese and U.S. markets.

We expect Canadian sales to post a robust rebound of around 15% y/y in 2021, and have penciled in 1.77 million sales units for the year. That would still be about 8% below 2019’s sales, but that pace of recovery would be unprecedented compared to previous recessions.

Ongoing COVID restrictions will dampen things in the short term, but vaccinations, ongoing job recovery, and the likelihood of more fiscal stimulus should make a difference. Here’s to a far better new year.

Click here to read the full report published by Scotiabank.

Rebekah Young is the Director of Fiscal & Provincial Economics at Scotiabank. With prior experience working with the IMF, and as a former senior official at the Department of Finance in Ottawa, she has addressed a range of topics, from development economics to the federal budget, to green finance issues.