Sales continue to stabilize, and even show some improvement

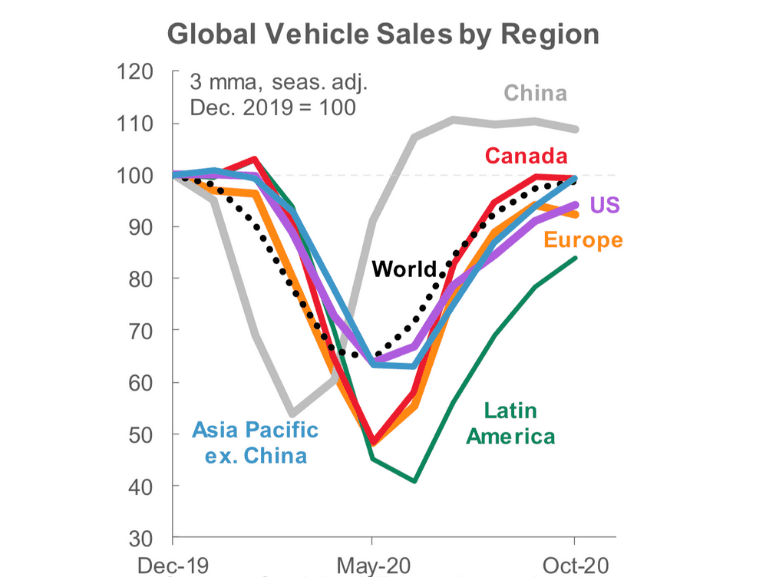

Global sales continued to stabilize in October, reaching positive territory for a second consecutive month since the pandemic struck. October sales rose 0.4% month-over-month, and while year-over-year sales are still down 18.2% year-to-date, they are trending in the right direction.

China continues to drive the global numbers, but all regions are showing stabilization or even modest improvements compared to the beginning of COVID-19.

Better-looking numbers in North America

Canada’s October sales stabilized with a modest 0.6% m/m deceleration, down 2.5% y/y. We expect moderate sales heading into the end of the year with second waves of the virus, and we’re already seeing some of that in Ontario and Quebec. But we also expect these will only dampen and not destroy demand in the near term, with some sales deferred into the new year.

The U.S. saw a modest pullback of 0.5% deceleration m/m in October. The virus will still affect sales, but reduced election uncertainty, and the possibility of near-term fiscal support, will likely put a floor under the auto-sales fall.

In Mexico, sales improved by 2.9% m/m in October, but were down 21.3% y/y. Improvements are expected, but at a slower pace in line with softer economic output, and more limited fiscal capacity to support the recovery.

European sales went the right way in October, but with volatility and variability across the markets. For example, Western European sales slowed by 6.3% m/m, but masked a 4.5% retrenchment in France offset by a 6.5% improvement in Germany. In South America, an overall 2% m/m increase marked the second month of solid rebounds across regions that suffered prolonged first waves of the pandemic.

Government support plays an important role

Worldwide, government supports have been a big part of the rebound, and are still playing a bridge role through the second waves in most advanced economies. In Canada, the federal government has announced program extensions well into 2021.

In the U.S., the prospects of near-term stimulus have grown substantially with Joe Biden as the incoming president, even if it might be muted in the context of a potentially Republican-controlled Congress. This, along with positive economic developments in the American economy, should have spillovers for Canada and Mexico, where auto exports have accelerated on the back of higher auto demand in the U.S.

Pre-owned and electrics gain momentum

Used vehicles are doing well in Canada, since a greater share of buyers shift to them when the economy is weak. Their retail value surged into positive territory in the summer, relative to pre-pandemic levels, while new-vehicle sales are now level with pre-pandemic sales volumes. Used prices are now starting to soften, which should support even stronger sales.

Electric vehicles are also gaining momentum on most continents. Two auto manufacturers are planning to build EVs in Canada, and with a looming federal EV sales target for 2025, we can expect more financial support for them. Even so, it’s suggested that battery technology advances could put EVs on price parity with gasoline vehicles as early as 2025, which would reduce the need for incentives longer-term.

As bad as the second waves have been on the economy, vaccine announcements and reduced U.S. political uncertainty are driving optimism. We can only wait and see.

Rebekah Young is the Director of Fiscal & Provincial Economics at Scotiabank. With prior experience working with the IMF, and as a former senior official at the Department of Finance in Ottawa, she has addressed a range of topics, from development economics to the federal budget, to green finance issues.