Canadian auto sales posted another rebound in July, marking a third consecutive month of recovery.

Sales have improved, but the pandemic is still having an effect.

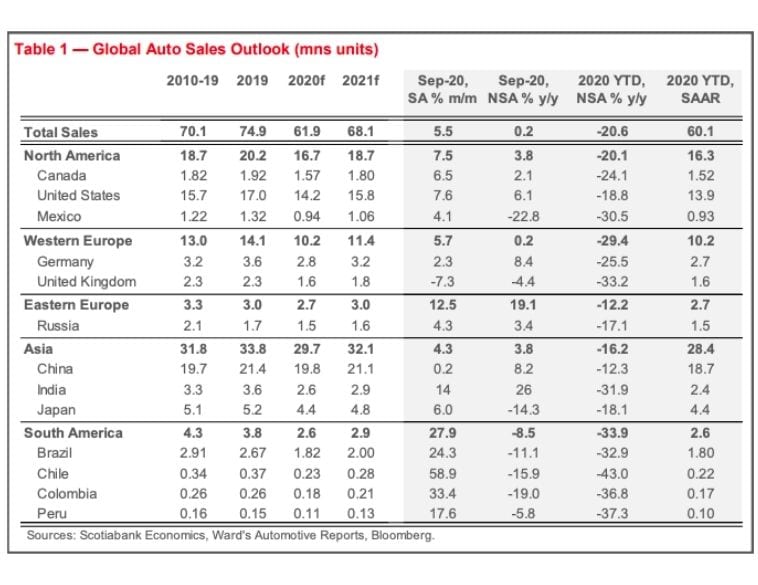

After robust rebounds in late spring and early summer, global vehicle sales normalized in September as expected, picking up by 5% m/m after a slight deceleration in August.

Sales were expected to slow as we headed into the fourth quarter and pent-up demand was satisfied. There have also been some supply challenges and lower consumer confidence that could push some purchases into the new year. Overall, global sales were down 21% y/y going into the fourth quarter, and we’re expecting headwinds as second waves of COVID-19 surge in many parts of the world.

A rebound in the forecast

For 2021 sales, we are forecasting a rebound of about 10% as the pandemic’s second waves are behind us, bringing global sales to within 9% of pre-pandemic levels.

The slight September recovery was led by China, which saw an 8% y/y increase, although sales were flat when compared to August. Western Europe saw steady improvement, while Latin American sales started to pick up.

Both Canada and the U.S. saw positive territory in September y/y for the first time, accelerating by around 7% m/m in both markets.

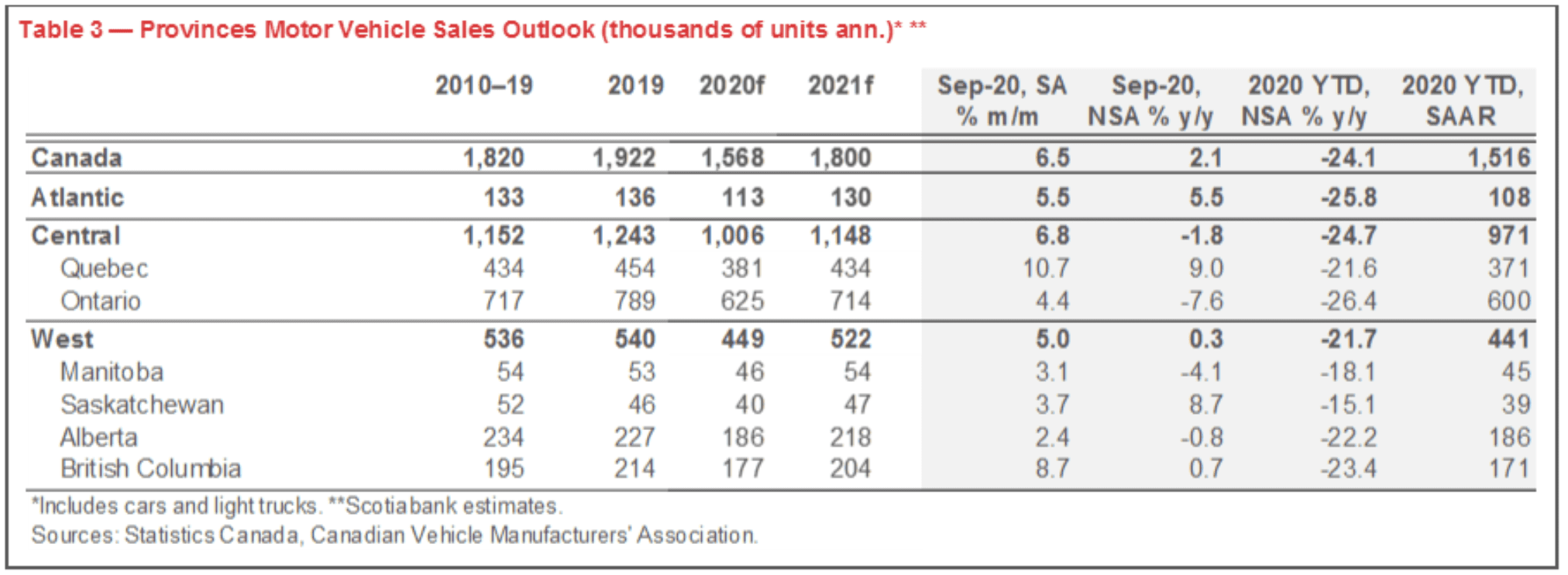

Different results across the provinces

Pandemic-related drivers have driven differences across provinces for the most part so far this year. Our preliminary data showed that while jobs increased in Ontario in September, auto sales dipped as COVID-19 cases started to accelerate in the province. Across Canada, Ontario posted the sharpest declines at the end of the third quarter, which is likely a reflection of more stringent and longer lockdowns in its largest cities, as well as stalled immigration inflows, since the province is the largest recipient of new Canadians. Sales declines in oil-producing provinces have been more muted, despite a more serious economic impact from oil shocks. As the recovery advances, traditional economic factors should dominate the auto sales’ outlook.

We may see an increase in used vehicle sales next year, which tend to operate counter-cyclically to new vehicles. Used-vehicle prices in Canada and other markets have rebounded substantially following an initial drop in spring. This is likely owing to supply constraints as many consumers extended their leases or deferred their loans, as well as a weak Canadian dollar that saw many used vehicles go to the U.S. But prices should drop as the vehicle supply increases, and so we expect used-vehicle sales to accelerate at a faster pace through the recovery.

A potentially stronger market

Because Canada had steeper declines than the U.S. in 2020, we expect a potentially stronger rebound here in 2021, at an anticipated 15% versus the U.S. rebound of 12%. Relatively similar economic recovery paths would bring auto sales to within 7% of their pre-pandemic levels in 2021 in both countries.

Sales in Mexico are expected to see much steeper declines of 29% in 2020, and a longer recovery will mirror its economic recovery. We forecast a 13% rebound in 2021, but that will still only bring sales to within 80% of pre-pandemic levels.

We add that the confidence levels around our forecasts are unusually wide, given these unprecedented times. Positive policies such as stimulus spending, or negative pandemic effects continuing into the new year, will all be factors as we move ahead.