The climb will be slow, but we’re starting to see hope with auto sales, both at home and across the globe. Canadian sales were up in June, although not as vigorously as they rose in May.

As more dealerships reopened, pent-up demand brought us farther up from the low point in April.

Second-quarter sales were down 45% y/y. We are holding to our annual sales forecast of 1.5 million units for 2020, and if reopenings continue successfully, we see the potential for an even stronger recovery.

However, we also see a possible risk that depends on evolving events in the U.S. and their effect on the Canadian economy.

Consumers are confident, but unemployment persists

In Canada, consumer confidence continues to nudge upwards, with a 16-point improvement in June, according to the Conference Board.

But it still sits at about two-thirds of pre-pandemic levels, and elevated unemployment is expected to persist over the course of the multi-year recovery.

Fleet sales will also likely dampen new-vehicle demand, as they comprise over 20% of total vehicle sales in Canada and the U.S.

A quick turnaround is not expected, especially since the rental car business is linked so tightly to air travel. Preliminary data suggests fleet sales were down 75% to 80% in April and May in Canada.

U.S. sales rise, but anything could happen

South of the border, sales also rose in June in the U.S. but were not up to May’s acceleration, and second-quarter sales were down by 33% y/y.

There were several factors in June’s more sluggish momentum, including more COVID-19 cases in some of the most populous states, and reports are that 1.4 million Americans filed for unemployment benefits in the last week of June alone.

We forecast national sales of 13.5 million units for 2020, but with a wide range of possible up- or downsides related to the ability of governments at all levels to manage the restart of their economies.

With economic activity picking up over the next eighteen months, our forecasts project output gaps closing by late 2021 in the U.S., and by early 2022 in Canada.

Uncertainty about the short-term rebound

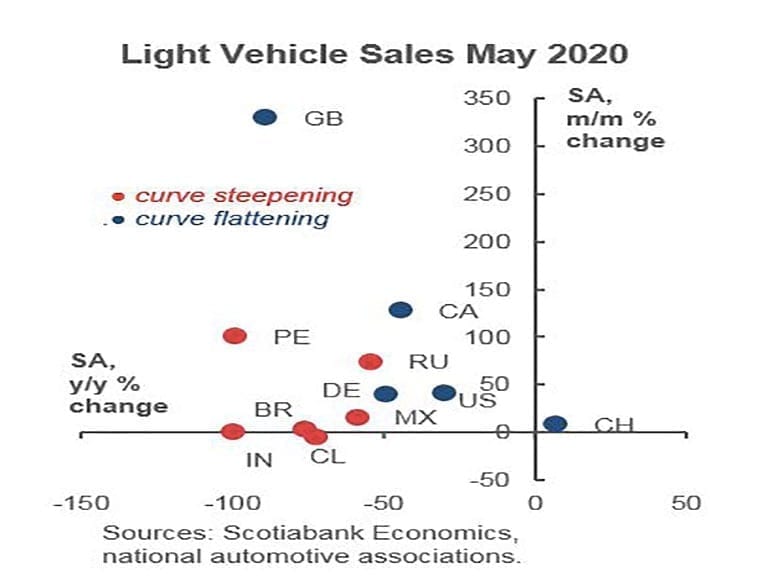

Globally, auto sales fell by 35% y/y in May, but that marked a moderation over the 46% y/y decline in April.

Pent-up demand is a benefit to many areas that are reopening their economies and their dealerships. China was exceptional, where sales rose by 7%, while other parts of Asia and Europe saw surges in their sales activities, although they remain below pre-COVID levels.

Globally, annualized sales were 51 million units in May, which is a rise of 22% m/m from April 2020.

Even so, most countries face considerable uncertainty about how long and how strong this near-term rebound will be before the fundamental economic drivers return.

For most countries, we expect this to create a multi-year recovery, as elevated unemployment puts a damper on consumption.

And some countries still face outbreaks and the resulting loss of sales, most notably Latin American and India.

We anticipate that by the end of 2020, global sales will sit 20% below what they were in 2019.