A number of factors are requiring operators to be highly focused on their margins.

During the early stages of the COVID-19 pandemic, where claims volume dropped rapidly, many collision centres had to pivot their operating practices to deal with a rapidly changed operating environment. Since then, we’ve seen claims increase again. In fact, Mitchell’s data points to an even higher frequency of collisions than we saw in 2019, prior to the onset of the pandemic.

Rise in distracted driving

According to sources such as the Insurance Institute for Highway Safety (IIHS) in the U.S., a big reason for the increase has been the rise in distracted driving and that applies even in vehicles that are highly optioned with multiple ADAS features. There is evidence to suggest that in the long term, ADAS will result in fewer collisions. However, at present, with more people driving than we’ve seen over the last few years, more of them distracted, plus more of them potentially relying too heavily on these safety features, it will be some time before those claims numbers start to decrease.

Besides a ramping up of collision frequency, another key issue impacting the collision repair industry across North America is shop capacity. A big reason for that is due to the high number of workers that left the industry during the pandemic, either through retirement or seeking new opportunities in different sectors. And the reality is, these people are not coming back. Apprenticeship programs have done a great job in filling the void left by those who’ve departed the industry, but we won’t see the impact of those programs overnight and it could be several years before the vacancies are filled in any meaningful capacity.

Rising repair costs

Another challenge facing the collision industry is rising repair costs and this is a trend that is likely to continue, particularly in the wake of the UAW strike last year. Even though agreements were reached, the result will mean higher part prices. Therefore, it’s expected we will see significant part price increases in the near term not only due to the strike but also inflation, which impacts repair costs. Even though better aftermarket parts availability is expected in 2024 as supply chain conditions improve, we still expect an overall 8% increase in repair costs this year.

On the OEM side, parts shortages continue to be an issue and it’s happening across the board, not just with specific vehicle manufacturers, or specific types of parts.

Additionally, as vehicle technology continues to advance, the frequency of ADAS calibrations and other software-related diagnostics and repairs will increase. To help ensure that these complex electronic systems are returned to pre-accident condition, it will be even more important for collision repairers to consider investing in the tools and training needed to bring that work in-house. Doing so can help them control costs, reduce cycle time and take advantage of new revenue opportunities.

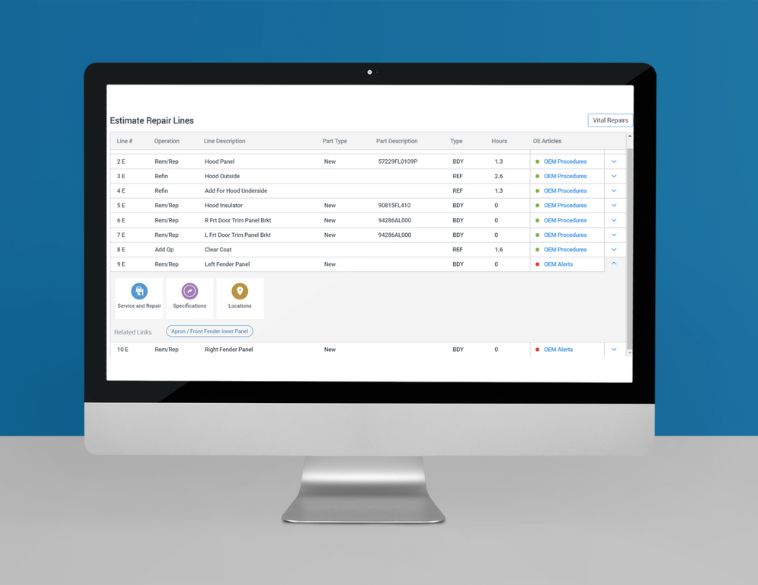

All of these factors have required collision repairers to be highly focused on profit margins as input costs have increased, with a prevailing mindset of looking at shop operations and ways to capture the greatest margins possible. In many cases, this means prioritizing repairs over parts replacement, having a more thorough blueprinting of each vehicle, more detailed estimates, and itemized repair invoicing. And because repairers are looking to extract more labour hours per job due to a decline in volumes driven by capacity and higher operating costs, we will likely see this passed on to the consumer in the form of higher insurance premiums, at least for the foreseeable future.

MONTRÉAL

MONTRÉAL Full time

Full time