Latest Scotiabank Economics report shows declines in both Canadian & U.S. markets.

Canada

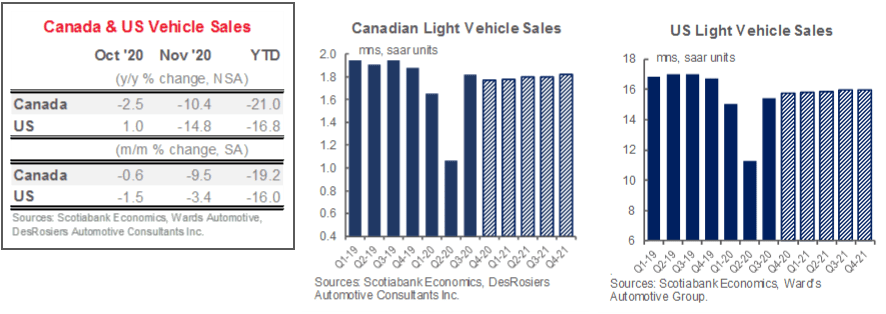

Canadian auto sales slowed substantially in November by -9.5% m/m (-10.4% y/y). This translates into an annualized selling rate of just 1.65 mn units, whereas auto sales had been averaging about 1.8 mn units over the past four months. More stringent lockdowns across major cities and regions in the country are likely the key driver behind the slowdown even though dealerships have remained open. Consumer confidence has also been stalling over the past two months with rising COVID-19 cases. Inventory shortages and fewer purchase incentives may also be creating some headwinds to sales as the end of the year approaches. A normalization had already been underway across a broad range of economic activities including retail and auto sales earlier this Fall. Anticipated second waves had been expected to dampen the auto sales recovery, in line with actual November performance. We expect sales to remain depressed in December, in line with earlier forecasts that would see sales end the year at around 1.56 mn units. Much like first waves, however, we expect some activity to be pushed out into the new year and foresee a healthy rebound to 1.8 mn units in 2021, albeit with some early-year headwinds until second waves are past.

United States

U.S. auto sales pulled back for a second consecutive month by -3.4% m/m (sa) in November. On a year-over-year basis, activity was down by a sharper-14.8%. The annualised pace of sales in November sat at 15.7 mn units. Following the stronger rebound this summer, sales had largely normalized around 5% below pre-pandemic levels earlier this Fall. Some modest dampening in year-end sales is expected owing to a combination of factors including escalating COVID-19 cases, inventory shortages, and high vehicle pricing. Auto purchase intentions, as reported by the Conference Board, had improved by a healthy 2 ppts in November, but a similar-magnitude decline in October may have fed through actual purchases in November. Otherwise, broader economic indicators suggest a normalization in activity, but not a stalling of the economy. Retail sales, for example, grew by a slower 0.3% m/m (sa) in October, while housing sales contracted by 0.3% m/m (sa). Unemployment declined again to 6.9% in the same month, and weekly jobless claims started to pick up towards the end of the month. The pandemic will likely continue to dampen year-end auto sales, which we forecast will land at 14.2 mn units for 2020. We anticipate a solid rebound in 2021 to 15.7 mn units with a strengthening recovery, renewed policy supports and second waves past.