After a strong start to 2020, the Retail and Wholesale Used Car markets experienced mixed results to finish the first quarter of 2020 (Q1 2020), according to data collected by Cox Automotive Canada’s Dealertrack portal and Manheim auctions.

“When looking at both the Wholesale and Retail Used Car Markets in Canada, our data shows a first quarter that began with positive signs but ended with the unprecedented impacts from Covid-19. During times like these, we hope that insights from our data can help the industry find a path to recovery quickly and efficiently so we can all get back to providing Canadians with the vehicles they need while also helping drive our economy forward,” said Maria Soklis, President of Cox Automotive Canada

Dealertrack Retail Used Vehicle Value Index Highlights

Based on data from Cox Automotive Canada’s Dealertrack Online Credit Application Network, the volume of Funded Used Vehicles decreased by 1.5 per cent in the first quarter when compared to same period last year. More specifically, the volume of Funded Used Vehicles was down 15.4 per cent in March year-over-year.

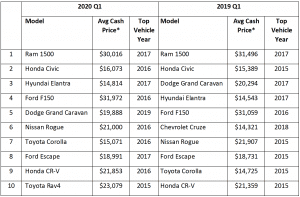

Average Retail Prices of Funded Used Vehicles in the first three months of 2020 experienced a 1.5 per cent reduction but 6 out of the top 10 had slight price increases compared to the same period in 2019.

Following the trend of 2019, the Ram 1500 full-size pickup was once again the top funded used vehicle in Canada during Q1 2020. Runner-up to the Ram pickup in volume, the compact Honda Civic remained the Top Funded Used Passenger Car in Q1 2020, holding on to its position from the end of 2019.

Compared to the first quarter of last year, the Q1 2020 Top-10 Funded Used Vehicles list sees the addition of the Toyota RAV4 replacing the Chevrolet Cruze. The fifth-place Dodge Grand Caravan minivan has dropped down from its third-place ranking in Q1 2019, and the Hyundai Elantra and Ford F-150 each moved up one place within the Top-10 list.

Soklis said : “When looking at our data and comparing the first quarter of 2020 and 2019, we see SUVs and Trucks taking an even stronger hold on the Retail Used Car market. The only small cars to make the top 10 were the Civic, Elantra and Corolla.”

“The data also shows that 6 out of the top 10 experienced slight price increases while the total average Retail Prices of Funded Used Vehicles saw a 1.5% year-over-year decrease,” added Soklis.

* values listed are an average price of all vehicles of that model sold, regardless of model year, trim, condition, etc.

Manheim Wholesale Used Vehicle Value Index Highlights

During the first three months of 2020, Cox Automotive Canada’s Manheim Canada Used Vehicle Index—a measure of average wholesale used vehicle prices based on a mix, mileage, and seasonally-adjusted data—recorded a small increase compared to the last quarter of 2019 but only a slight year-over-year increase.

Despite the impact of Covid-19, our data shows that Wholesale Used Car prices still experienced slight increases in the first quarter of 2020 when compared to both the first and last quarters of 2019.

— Maria Soklis, President, Cox Automotive Canada

“Also of note, while several segments experienced price increases from the last quarter of 2019, SUVs once again showed their strength in Canada as the only segment to achieve a year-over-year increase. With the industry now experiencing what we hope is the worst of the pandemic, it will be interesting to monitor further impact to the average prices as we move into April and the remainder of the second quarter.”

In the first quarter of 2020 (Q1 2020), the Manheim Canada Used Vehicle Value Index recorded an 8.9 per cent rise to 150.9 per cent, compared to the last three months of 2019. However, based on a year-over-year basis, the Used Vehicle Value Index only saw a 2.6 per cent increase. Compared to its highest peak of 157.7 per cent in Q2 of 2019, the current Q1 2020 Index is down 6.8 per cent.