In February, Craig Edmonds was named as President of asTech. Edmonds brings more than 36 years of experience in the automotive insurance space to the role, including key positions with carriers such as Progressive and Allstate.

In his current position, Edmonds is tasked with the ongoing evolution of asTech’s proprietary and market-leading All-In-One technology platforms, as well as leading the development of key strategic partnerships and establishing business strategies.

Autosphere recently had an opportunity to interview Craig and we asked him about how he got started in the insurance business, some highlights of his career, as well as some key factors influencing relationships between insurers and collision repairers in the market today. We also asked Edmonds about current trends impacting the collision repair space and how asTech is helping to advance both the repair process and overall customer experience. Here’s what he had to say:

Autosphere: Congratulations on becoming President at asTech. Can you share with us a little about your background and how you got involved in the automotive insurance space?

Craig Edmonds: I started with Progressive Insurance right after graduating from the University of Georgia. I was at Progressive for 27 years and was fortunate enough to hold a lot of different roles. I started out as a general claims adjuster, worked my way up to a branch manager and regional manager and then, in 1999, I was given an opportunity for a corporate role, which was to start Progressive’s DRP program.

Prior to this program, Progressive’s repair agreements and relationships were local and more of a preferred network agreement. My role was to establish a national program and it proved to be a phenomenal experience—one where I gained a tremendous amount of knowledge and experience, as well as gaining considerable insight from the perspective of collision shop operators. I later moved into the leading Auto Physical Damage at Progressive and Allstate, including 5 years at Allstate’s subsidiary Esurance. Following my tenure at Allstate, I joined Repairify and was recently named President of asTech.

AS: Given your experience and background where do you feel the biggest potential issues for friction lie between insurers and collision repairers?

CE: I feel there has always been a natural friction between insurance carriers and collision repair facilities, that in some respects, is healthy, though it often depends on the shop and the insurer. Ultimately, both parties have a common goal and that is to complete the repair and return the vehicle to the customer in fully functioning, pre-collision condition. And both parties need to collectively work towards that goal for their shared customer, the motorist.

We’ve seen vehicle technology and repair procedures rapidly evolve over the last two decades and as complexity increases, good repair planning becomes ever more important. This means that often, the “natural” friction points we saw in the past between insurer and repairer, are no longer as relevant, since brand protection and reputation for each stakeholder is paramount, which will be dictated by the quality of the repair and the satisfaction of the end customer, the motorist.

AS: How have severity trends, rising repair costs and parts availability impacted the dynamics between collision repairers and insurers and is there anything to consider in that regard?

CE: There’s no question that these external pressures impact both collision repairers and insurers. When repair costs and labour costs increase due to a technician shortage, door (labour) rates and repair capacity are impacted. Collision shops currently pay a premium for technicians due to high demand. Plus, when you’re faced with supply chain issues, parts availability is impacted, which in turn can lead to higher parts prices, influencing decisions on whether a component can be replaced, or whether it should be repaired. Therefore, whether it’s a labour issue, supply chain issue, or technology, it can put pressure on profitability for the collision centre.

It’s important at this point to differentiate profitability from revenue. We’ve seen situations where collision centre revenues have increased but that doesn’t necessarily mean profitability has. When you’re faced with higher operating costs, profit margins can be compressed, and that applies not only to the shops but to insurers as well. Many of the big insurers are publicly held which means you can view their statements and earnings. And while the tide is starting to turn, in 2022 and 2023, many prominent commercial insurance carriers lost money, and that impacts premiums, which impacts customers, creating this circular effect for the consumer, insurer, collision centre and other stakeholders in the industry.

AS: Going forward, what do you think will be critical for insurers and collision repairers to consider when it comes to claims, estimates, repair plans and delivering consistent, good quality and safe repairs?

CE: I think it is incumbent upon both collision centres and their vendor partners, as well as insurers, to leverage technology to help us improve the overall repair process. And a big part of that boils down to having clear, comprehensive, and efficient repair plans. We’re seeing that technology is changing the game, enhancing the process, and enabling collision centres to develop better repair plans. For an organization like asTech, it is a great opportunity to provide value for both collision centres and insurers and by extension, other stakeholders, including rental car providers, OEMs and end consumers.

AS: What do you think are the biggest benefits a vendor like asTech can provide both insurers and repairers when it comes to the overall repair process and customer experience?

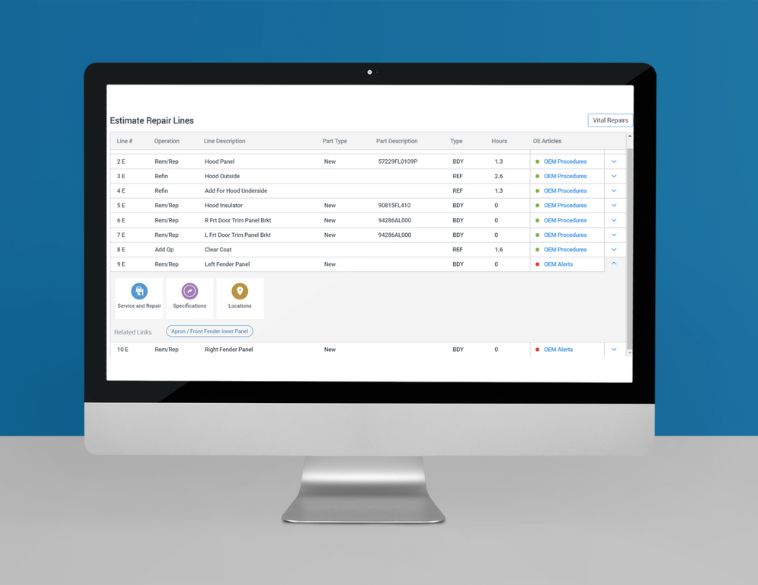

CE: We see benefits for both repairers and insurers. One thing we’re excited about is how asTech can bring data-driven, intelligent solutions that touch the entire repair planning process. And that impacts all stakeholders involved in the process—from the repair facility—to the insurer, to the end consumer. All benefit from collision diagnostics and pre-scanning the vehicle. asTech’s patented and proprietary Rules Engine provides repairers and potentially insurers with the intelligence to determine whether an OEM scan or aftermarket scan should be performed prior to a repair. This is truly critical for the collision repair process, particularly as it relates to accurate repair data, as well as the repair plan and billing/reimbursement.

Additionally, asTech’s unique ability to connect directly with OEM scan tools gives us the point-to-point data touch with the actual gold standard, which is the OEM tool. We’ve invested years of research in developing the Rules Engine, which can also identify when a non-OEM or local scan can be performed. And when a non-OEM scan is performed, we have AI-driven reports called asTech Insights, that help the shop understand what needs to be done so that the vehicle repair process can move forward as quickly, accurately, and efficiently as possible.

Furthermore, when you get beyond the whole scanning process, we also have adasThink, which is a tool that allows the repairer to understand when a calibration is needed. A comprehensive set of diagnostics and repair recommendations allows the repairer to understand 3 things; (1) the extent of the damage to the vehicle; (2) what equipment is on that particular vehicle and (3) the OEM requirements for properly completing that repair. We can also determine if a specific calibration is needed, what type of calibration, and link that to the technical solutions so the shop and its technicians can complete that repair.

When you think about that from the perspective of the repairer, they can understand whether only scanning, or scanning and calibration is required, we have tools that can really help that repair planning process for the collision centre and, also the insurer. This gives them confidence in what is required and, whether or not a calibration has been performed properly. We believe this will help both collision centres and insurers clarify what procedures were performed, what can be billed for, and reimbursed related to each repair.

AS: On the data side, what do you think is essential for insurers, estimators, and collision repair shop staff, including technicians to have access to in order to prevent any delays in the repair process or any other issues such as supplements, back ordered parts, problems accurately repair mapping and scanning/calibration requirements?

CE: What we’re seeing is that increasingly, collision centres and other stakeholders involved in the repair process are relying on data-driven solutions. By doing so, they are ensuring that nothing in that process is left to opinion or interpretation, but instead, is driven by an accurate and efficient repair plan that’s based on the facts. Whether a sheet metal repair takes three hours or five hours is often a judgment issue as is a borderline repair versus replace decision. There will always be some judgment issues when it comes to collision repairs, particularly during the estimate and repair planning phase, but in terms of scanning and calibration, we can remove a lot of that judgment and replace it with detailed and accurate information via data-driven solutions.

AS: Going forward, what are some of your key objectives when it comes to your new role at asTech?

CE: Essentially, that asTech continues to lead the way as the pre-eminent diagnostics, calibration and automotive intelligence partner for collision and mechanical repairs. Ultimately, the goal is to help collision centres in their endeavour to repair vehicles safely and accurately, ensuring they’re consistently brought back to true pre-collision condition. The exciting thing for me is knowing I’m part of an organization that has the tools, technology, and data to help the collision centre, insurer and other stakeholders deliver the best quality, most accurate and most efficient vehicle repairs.

TERREBONNE

TERREBONNE Full time

Full time