These core topics were front and centre at the third final event of the year.

October 6-7 saw collision repair industry professionals and key stakeholders gather for the third Canadian Collision Industry Forum (CCIF) event of the year.

Taking place at the Westin Calgary Airport, there were ample networking opportunities as well as sit in on some great content. Following the networking reception on October 6, CCIF Chair Jeff Labanovich kicked off the formal part of the event on October 7. Labanovich reiterated the importance of the three pillars impacting collision repair today Profitability/Sustainability, People and Vehicle Complexity and bringing the right content and conversations to the table.

“What are we bringing to the industry when we’re talking about profitability” asked Labanovich. “How are we going to solve our deficit in human resources – our talent, our training,” he said, while acknowledging some of the promising discussions happening at the CCIF Steering Committee.

Greater engagement

Labanovich also discussed the current relentless advance of automotive technology and how growing vehicle complexity also presents an opportunity for even greater engagement with OEMs to ensure vehicles are fixed properly and efficiently.

Labanovich stressed that ultimately, it is critical for open, clear communication between all collision industry stakeholders to ensure the sector has a bright and prosperous future. He also commented that positive conversations today are leading to greater participation of OEMs at upcoming meetings, and he encouraged more individual shops and their teams to attend. By also stressing the importance of participation and being actively involved and connected with CCIF, Labanovich noted that the benefits for all stakeholders are very significant.

Looking to the new year, Labanovich also announced that at CCIF Toronto (February 8-9), the popular trade show format will return for 2024, providing vendors, sponsors, and industry stakeholders the opportunity to showcase their latest products and solutions at the event. Additionally, the three event per year format will be altered to two events, with a second forum planned in Montreal from September 19-20.

The reason for the change, Labanovich noted was to promote additional value by being able to focus attention on two well-attended events on the calendar—taking into account time commitments for those in the industry, and the ability to providing rich, thought-provoking content and ample accommodation and networking opportunities.

Following Labanovich, Mike Hughes, Academic Chair, Autobody Program for the Southern Alberta Institute of Technology (SAIT) took to the stage.

All avenues

Hughes talked about the need to bring people from all avenues into the collision repair trade and he mentioned that a big challenge, even today, is a lack of awareness among the public about what autobody repair is and the opportunities available. “We need new talent,” Hughes explained, noting that creating opportunities to not only educate people, but ones that fit their lifestyle is important. To that end, Hughes stressed that his goal at CCIF was to provide ideas on a national level that key stakeholders could take home with them and discuss with local colleges to promote skilled trades and auto body repair.

In Alberta, Hughes explained that the autobody trade has an annual growth rate of approximately 2%, with 4100 jobs in the province and 77 new positions available each year. With a total of 7300 positions currently open and only 6200 people available to fill them, there is a significant labour shortage—one reason why SAIT is focusing on new solutions to bring people into the trade.

These include:

- Turning Points – a program for at risk youth ages 18 and under, designed to provide an authentic and engaging experience with the goal of enabling them to select a skilled trades career that appeals to them. Grants are also available for these students to pursue a career in the auto body trade.

- Building Futures – A six-week program where students have the opportunity to build a house and gain exposure to the trades sector including learning soft skills

- Exploring Transportation Trades – a 15-week program that’s sponsored by both industry and provincial government, that brings in students from 14 different schools within the Calgary district. The program includes basic training and also, training in first aid and other safety practices including Workplace Hazardous Materials Information System (WHMIS) and Fall Protection. Hughes noted that this program is already proving a highly effective introductory program for Grade 11 and 12 students in understanding what autobody repair really is, providing a solid stepping stone to forging a rewarding career in the auto body and car painting trades.

Combined with SAIT’s existing programs, including its Registered Apprenticeship Program (RAP) as well as multiple open houses and education events, plus active involvement in the provincial Skills competition, the opportunities for students to enter and succeed in the auto body and car painting trades has never been greater. SAIT also has a Youth Initiatives Group that liaises with local high schools and colleges to promote skilled trades and increase awareness of what has proven time and again, to be a vital and rewarding career opportunity.

Shifting gears from education and training to what’s actually happening at the repair level in the industry, Nick Dominato, Director of Product Management for I-CAR delved into ADAS calibration market sizing and new technology developments.

Exploding market

Dominato noted that currently, the ADAS market is exploding. Most vehicles that are six years or newer feature some kind of ADAS technology and by 2030, it is expected that 80% of all vehicles that enter a collision shop will need some kind of ADAS calibration.

Dominato explained that in Canada, approximately 1.2 million vehicles are repaired each year and of those, approximately 140,000 were calibrated in 2022. This results in an overall calibration rate of 11% and a market size of $51 million.

With a typical shop processing around 50 vehicles per month and only calibrating six of them, Dominato said that our industry is missing out on a huge opportunity. “We need to do a better job at identifying ADAS calibrations,” said Dominato. Based on current trends, with 2/3rds of calibrations not being identified or performed, the market is likely to grow from $51 million to $150 million by 2030. If, however, shops and the industry step up to the plate, Dominato noted that the market opportunity could grow by 25% on an annual basis, reaching $370 million by 2030.

More complicated

In terms of new technology, Dominato explained that vehicle complexity will continue to increase, with OEMs becoming more concerned about cyber security risk when it comes to electronics including repair information and ADAS systems. Translation? It is going to become more complicated and difficult to repair vehicles going forward, with more procedures and function checks required. “You may have to program a sensor, connect to the cloud, do the calibration and function check. That will be the required mindset,” said Dominato. Highlighting the growth in radar power test requirements, where for example, shops need to see if a painted bumper cover obstructs radar sensor operation, the concept of asking if a car needs ADAS calibration is no longer valid. Instead, shops and technicians must be asking “what suite of processes are necessary to repair this vehicle properly.”

Another area of the collision repair space that’s drawing greater attention, particularly among insurers are Environmental and Social Governance (ESG) practices. To provide an idea on what these are and what it means for collision repairers, Peter Kalantzis, Assistant Vice President, National Auto Claims, Appraisal and Supply Chain, and Michelle Li, Vice President, Corporate Planning, Performance and Business Partnering from Aviva Canada, provided an overview and some ways in which shops can promote environmentally sustainable practices when it comes to claims. Some key areas that can make a difference include using LED lighting, white roofing that better reflects sunlight and reduces heat absorption, as well as focusing more on repairing parts and less on replacing them. Kalantzis noted that in this kind of scenario, not only does it result in a more profitable repair for the shop (since labour rates are higher), but it also expedites the repair process since the work is completed faster, meaning the customer gets their vehicle back more quickly, bolstering the relationship between them and the collision centre. When replacing parts is the only option, working with automotive recyclers as opposed to acquiring newly manufactured OE or aftermarket parts can be a big saving when it comes to reducing costs, carbon footprint and speeding up repairs.

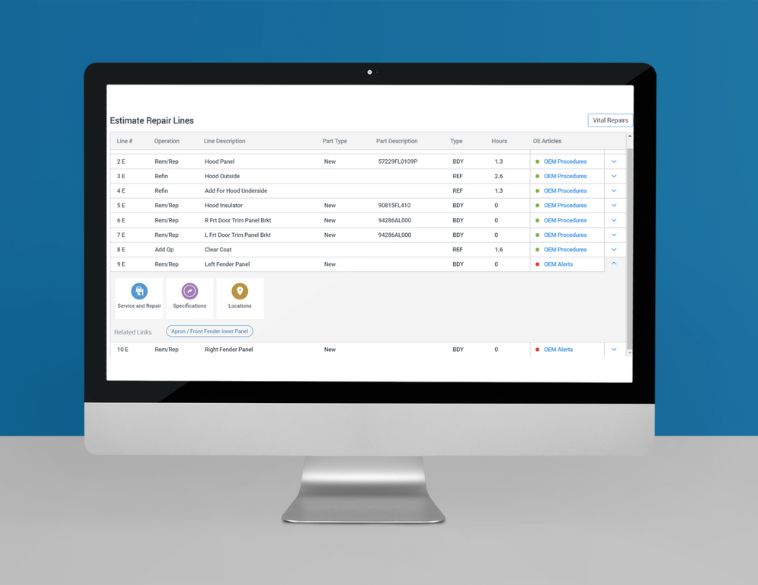

There’s no question that today many businesses, including collision repairers, face a multitude of challenges. Taylor Moss, Manager, Repair Intelligence Team at OEConnection looked at proven strategies and tactics to prepare for future opportunities by taking a look at four core areas of business operations. These are:

- Customer Experience

- Repair Process

- Sharpening the Saw

- Financial Practices

Relating to customer experience, Moss said it was imperative that shops have and follow a documented customer journey. Within this journey, regular communication updates are essential, so the customer knows how the repair is progressing and can plan accordingly. Additionally providing added value service such as vehicle cleaning, detailing and follow ups after the vehicle has been delivered can make a big difference when it comes to customer experience and satisfaction.

Regarding the repair process, Moss stressed the importance of having a written, documented repair plan and knowing what role each employee plays in shop operations. Additionally, he said it was key to identify the strengths of each employee and leverage them to improve overall productivity. Good pay, benefits and time off are also key considerations in today’s highly competitive job market and by offering them, not only are your employees more likely to stay, they are likely to perform better as well.

Protecting staff

In terms of sharpening the saw, Moss said it was important to have the right processes to protect staff from the dangers of performing repair work, such as working on electric vehicles and high voltage systems. Investing in new technology and staying current with repair procedures, software updates and other business practices required to perform effective quality repairs is also essential. Additionally, Moss noted that shop cleanliness and organization, as well has having tools that are well maintained and replaced at the required intervals are also essential aspects of a well-run successful shop.

The final component he touched upon, was financials. This included keeping track of all invoices, collecting all payments, and dialing in proper repair plans that incorporate all costs associated with performing each repair. Additionally, knowing KPIs and how much profit the shop makes each month, and each year are essential to tracking progress. Finally having a team of financial professionals is also key to ensure the business stays on track and is run effectively and profitably.

Cecile Bukmeier, Program Chair, Northern Alberta Institute of Technology (NAIT) discussed technician trends in collision repair. A former provincial, national and World Skills contestant and apprenticeship trainer, Bukmeier talked about the stigma that still exists around skilled trades and that they don’t lead to career success, when in reality, the opposite is often true.

She noted that the growth in banner shops and MSOs provides a uniform standard for repairs and operational procedures, and newer technologies have allowed for cleaner repairs and a much-improved work environment. Nonetheless, many shops still face challenges in recruiting technicians. A big one not only concerns perceptions among the trade among the public, but also expectations among young people. Bukmeier said it was important to understand that an apprenticeship today represents an investment in the future of an individual’s career, meaning that while initial wages may not that high, over time, the benefits far outweigh the initial investment, plus unlike traditional university degrees, those apprentices get to earn as they learn.

Highly diverse

Nonetheless, there are significant challenges. Today’s workforce is highly diverse, with more immigrants and women choosing skilled trades like auto body repair and car painting. With newcomers, Bukmeier acknowledged that initially, language barriers can pose a problem, though that should not deter shop owners and managers, particularly if they prove to be highly skilled and adaptive to learning the proper processes and procedures. Plus, with more women entering the trade, there is a greater opportunity for different views when it comes to approaching collision. Nevertheless, challenges remain. Many young people today aren’t equipped with basic hand skills, due to the lack of investment and closing of traditional high school shop and technical programs over the last several decades.

They also have different attitudes in that many of them want to do “meaningful work,” i.e.— contributing—both to the organization and the local community, as well as having a good work/life balance (not having to work extra jobs just to put food on the table). Additionally, Bukmeier noted that today’s young people are also looking to the future, wanting to see where their career path will take them and not just looking at it as a job where they trade their time for money.

“The want to learn how to work on the cars, and how to fix them properly,” she said, “but they don’t want to be that 60-year-old technician who is looking for somebody to replace them.”

Coatings solutions

The final session of the day came from Jeff Wildman, an automotive aftermarket expert with BASF. Wildman discussed the issue of radar sensor functionality, raised earlier in the day by Nick Dominato, and how BASF has been actively working on coatings solutions to tackle the problem of sensor disruption caused by painting and pigmentation.

“Coatings [today] are a functional part of ADAS systems,” Wildman explained. He noted that often, metallics can pose a problem due to the size and shape of metallic flakes and the way they lay on the coating itself. “These all impact radar sensor operation,” he said.

That’s why he says it is imperative to follow Technical Data Sheets published by BASF and other coatings manufacturers that are essentially OEM directives on how to repair the vehicle and apply coatings. He also stressed the importance of providing the right information to estimators so they can properly do their job and talk to insurers and customers, ensuring the work gets completed and each stakeholder is aware of the processes involved and why they need to be performed.

In talking about safe and proper repairs, Wildman emphasized five key factors:

- Repair procedures

- Equipment

- Knowledge

- Process

- People

By considering all of these, shops can save time, ensure repairs are performed properly and consistently, while at the same time boosting their reputation and profitability. He noted it was important to consider these factors, since “no other industry is undergoing such rapid technological change as the automotive industry.”