Expect ups and downs, rather than a straight upward trend.

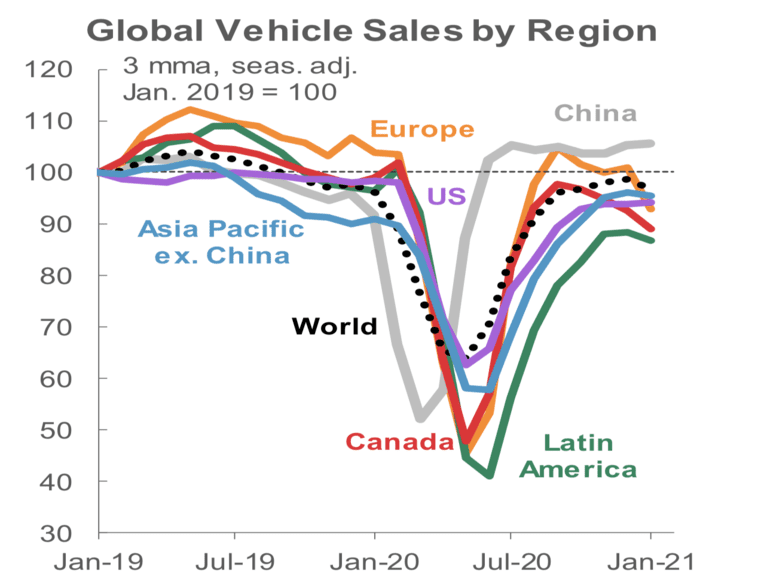

Global auto sales continued their volatile recovery in January of 2021, with a rise of 1.4% over January 2020. However, it was an 8% global drop from December 2020. Part of that is due to how each region performed. Some, like China and the U.S., are well on the road to recovery, but many European markets have seen significant retrenchments in their second and third COVID-19 waves.

Comparing this year to last

Restrictions are lifting in many areas, but we still expect to see instability until there is significant progress in global vaccinations. The outcome also depended on the numbers being compared. For example, China posted a 27% y/y improvement in January 2021, but that was against its 20% decline in January 2020, when it was one of the first regions affected by pandemic constraints.

Sales in the U.S. were up a modest 2.5% y/y in January, and down only 4% from December. That’s likely due to a second round of stimulus cheques, and sales should continue to strengthen as the Biden administration provides more assistance in the future.

Gains and losses across Canada

Canada’s sales moderated in January 2021, as tight lockdowns restricted activity in the largest provinces. Sales picked up outside of Ontario and Quebec, but they were down by 20% and 39% y/y, respectively. That resulted in nationwide sales that were down 12% y/y in January, but with only a drop of 6% from the previous month.

Even though those weaker sales represent a setback, the annualised sales rate in January is still about 200% stronger than it was at the peak of shutdowns during the first wave, which suggests there has been some adaptation to pandemic restrictions.

We do expect to see ups and downs over the next couple of quarters, due to consumer behaviour such as deferring purchases or dealing with COVID-related restrictions that may be tighter in larger cities, as well as any vehicle supply issues. However, we also expect the weakness to be transitory, as buyers give in to pent-up demand.

The chips are down

The supply issue is going to be a major factor in sales as well and on a worldwide basis. Automakers are struggling with microchip shortages, made worse as they compete for them with an electronics industry that has boomed for work-at-home products. It’s a slow, difficult process to ramp up chip production, and shortages are expected to carry through into the second quarter of 2021.

On top of that, many auto plants in the southern U.S. were shut down or constrained by unprecedented storms. North American auto production was down by 14% y/y in January, according to Wards Automotive, which has revised its first-quarter production forecast to a drop of more than 300,000 units to 3.7 million vehicles.

Canada’s economic indicators continue to outperform consensus forecasts, with the Conference Board reporting an increase in consumer confidence in January. We expect the recovery to experience downsides, rather than a straight upward trajectory, but we are maintaining a forecast of a better second-half performance, and a healthy rebound to 1.8 million units in 2021.

Rebekah Young is the Director of Fiscal & Provincial Economics at Scotiabank. With prior experience working with the IMF, and as a former senior official at the Department of Finance in Ottawa, she has addressed a range of topics, from development economics to the federal budget, to green finance issues.