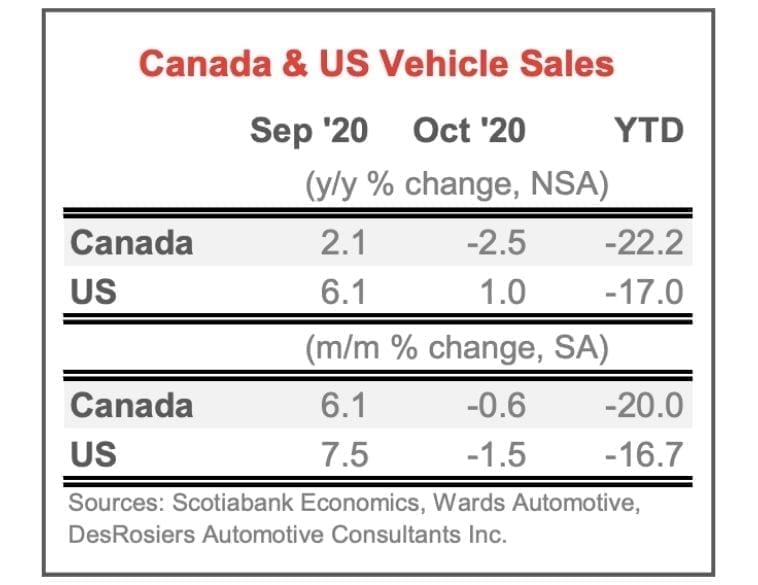

In a report by Rebekah Young, Director, Fiscal & Provincial Economics of Scotiabank Economics, numbers for vehicle sales for Canada and the U.S. for October 2020 were calculated.

Canada

Canadian auto sales stabilized in October with a modest -0.6% m/m (as) deceleration, sitting 2.5% down year-over-year. October’s selling rate at 1.85 mn saar units is only 5% below 2019 annual sales. This mirrors the broader economic recovery where gains are largely moderating following impressive rebounds in the immediate aftermath of lockdowns. GDP guidance for September estimates the economy grew by 0.7% m/m, while surprisingly strong job growth that month underpinned the recovery, adding 290k jobs (mostly parents), but October numbers are expected to be sideways.

Retail sales in September were flat, but levels had already surpassed pre-pandemic activity in the summer so a stabilization was not unexpected. Escalating second waves across most of the country will likely increasingly weigh on confidence—and more concretely, on job security in targeted sectors facing restricted activity—until curves start flattening. In fact, consumer sentiment, as reported by the Conference Board, dipped by a substantial 9 points in October, while major purchase intentions also deteriorated. This will continue to present headwinds for auto sales, but the new employment benefits that started in the second week of October should provide some support as it effectively restarts the clock for claimants who may have exhausted benefits under the old scheme. Further domestic policy support is also expected in the Fall budget.

Young maintains their sales forecast outlook at 1.6 million units for 2020 with still some potential for volatility in the final stretch.

United States

U.S. auto sales saw a pullback of -1.5% m/m (sa) in October. On a year-over-year basis, activity was modestly positive at 1%, but performance is likely overstated against this metric given GM strikes affected last October’s sales as well as an additional selling day this year. While there has been a steady moderation in recent months following the initial rebound in U.S. auto sales, purchases are by no means stalling. October’s selling rate of 16.2 million units is less than 5% below last year’s annual sales.

A broader range of economic indicators continue to hold up against second (or third) waves of the pandemic—at least in September—including a stronger-than-anticipated Q3 GDP print, a solid 1.9% m/m pick-up in retail sales, and similar strength in housing starts. Unemployment also edged down (to 7.9% in September), while more recent weekly jobless claims continued to trend downward in October. Personal income was also up modestly (0.9%) in September. Housing sales, on the other hand, which contracted by 3.5% m/m (sa) in September, are arguably more forward-looking with a closing lag. Other forward-looking indicators also paint a mixed picture: the University of Michigan’s consumer confidence survey showed a mid-month improvement in sentiment, whereas the Conference Board finds the opposite. Importantly, auto purchase intentions under the latter survey showed a sharp pullback of more than 2 points.

Young maintains their 2020 forecast at 14.2 millon units.

While Young consistently underscores the downside risks to our outlook, there is also some upside if election outcomes provide greater certainty such that Americans further draw down still-substantial household savings over the remainder of the year, along with an expectation of greater supports.

MONTRÉAL

MONTRÉAL Full time

Full time