The 17th annual white paper, A 2022 Profile of the Evolving U.S. and Canadian Collision Repair Marketplace, is now available.

In this 17th edition of the annual white paper, Romans Group continue advancing their insights in the evolving U.S. and Canadian collision repair markets. Pre-COVID 2019 had been the apex year for the highest U.S. collision repair industry TAM in history at $38.6 billion. The new industry benchmark for opportunity and success is now 2022 with an industry TAM of $44.8 billion.

Despite the continued technician shortage, this was possible due to the industry’s general improvement in better optimizing production throughput and the ongoing increase in severity throughout 2022 and continuing into 2023. The recovery from the pandemic’s downward impact in 2020 and 2021 continues to have near-term relevance for comparison purposes for the post-pandemic years of 2022 and 2023. The recovery continues its steady growth despite the tightening economy for the North American collision repair industry and the broader auto physical damage landscape.

The steady number of vehicles on the road and a consistent and stable number of car accidents continues to fuel demand for collision repair services without any significant decrease in sight. However, the collision repair technician shortage in the United States remains a significant challenge impacting the ability to repair and service these vehicles in a timely manner.

Collision Repair Industry

Some highlights of a generally recovering and improving collision repair industry:

- As 2023 was the year for everything artificial intelligence, it was no different for the collision repair space. Its use and introduction as part of many organizations’ solutions to solve many of the industry’s problems has been announced and marketed throughout many of the segments within the broader auto physical damage landscape.

- Some progress has been made between insurers and OEMs regarding the growing adoption and implementation of OEM vehicle repair standards and how to balance and resolve keeping the repairer out of the middle of these two sometimes conflicting repair processes and procedures.

- The collision repair space continues to deliver its long-term proposition of proven economics and growth supported by insurance-industry-driven demand dynamics that create cash flow stability and profitability for many of the best operators. Over the past decade, because of this value proposition we have seen the influence of private equity’s investment growth strategy targeting both larger and now smaller independent MLOs.

- With regard to physical growth, the benefits and risks to all consolidators continue to be the ability to quickly, efficiently, and effectively integrate expansion and acquisitions. This includes managing and navigating new market dynamics and scale, growing their client and revenue base, the ability to balance ongoing insurance DRP and OEM certification program requirements, leveraging supplier relationships and the economies of purchasing power, as well as their ability to effectively integrate their systems and business operating model within their new single-and multiple-location markets.

- United States EV sales increased in 2022, versus an overall decline for total U.S. auto sales. While EV sales and inventory share grows, so does the total cost of repair and the number of parts replaced on EVs compared to non-EVs. While vehicle sales and market share growth continue their forward momentum, there is a possibility of a slowdown as EV inventory increases.

- Industry growth and expansion creates the opportunity for an inevitable change and shift among MSOs, insurers, and OEMs in the balance-of-power dynamics, especially in many of the more consolidated markets such as Dallas, Chicago, Los Angeles, and Philadelphia. The industry is one step closer to a tipping point where the consolidated MSOs’ revenue outnumbers the remaining independent and dealer consolidated revenue and industry scale.

- During 2022, a more aggressive group of mid-size private-equity-funded consolidators accelerated both their single and multiple-location acquisitions and geographic diversity. The strategic focus at this time for many consolidators continues to be to pursue both new and existing market growth through single and multiple-location acquisitions. However, this expansion focus has been slowed by the economic realities associated with increased financing costs for acquisitions and re-capitalizing businesses.

Multiple Location Operator, MLO, Segmentation

Throughout this report, we segment U.S. collision repair organizations in a variety of ways:

- Independents

- Dealers

- Top three consolidators

- ≥$20M Multiple-Locations Operators (MLOs)

- $10M-$19M MLOs

- ≤$10M MLOs

- Franchise/Banner/Multiple-Location Network (MLN)

- Private equity and other investor-sponsored MLOs

- All other remaining relevant repairers

The ≥$20M segment, especially the top three independent consolidators, Caliber, Gerber, and Crash Champions, continue to grow steadily, underpinning the long-term collision repair consolidation trend. Their marketplace leadership continues due to:

- Increasing levels of regional and national network scale.

- Organic revenue growth based on market scale, brand recognition and network performance.

- Insurer DRP and OEM certification relationships.

- Customer acquisition segmentation.

- Multiple-location platform acquisitions.

- A steady number of strategically placed geographic single-location acquisitions coupled with greenfield and brownfield development.

- Ability to integrate acquisitions and implement operational and performance improvement.

- Ability to leverage capital expenditures for future growth and development.

Canadian Market

During 2022-2023, the Canadian collision repair industry continued its uneven recovery from the pandemic. Many of the risks and challenges within Canada were similar to those in the U.S. market.

Opportunities to increase revenue production have carried forward throughout the year due to an increase in sales driven by higher repair costs and parts inflation, vehicle repair complexity, and increased scanning and calibration services. Despite this improvement, a constrained production environment continues due primarily to the ongoing technician shortage and increased delays with insurance company response times to appraise and adjust estimates and vehicles repairs.

Starting in 2022, up to 70 percent of repair facilities began refusing to take non-drivable vehicles. Some shops were booking out for seven to nine months and the thought was that avoiding non-drivables would make more space for quicker turnaround repairs.

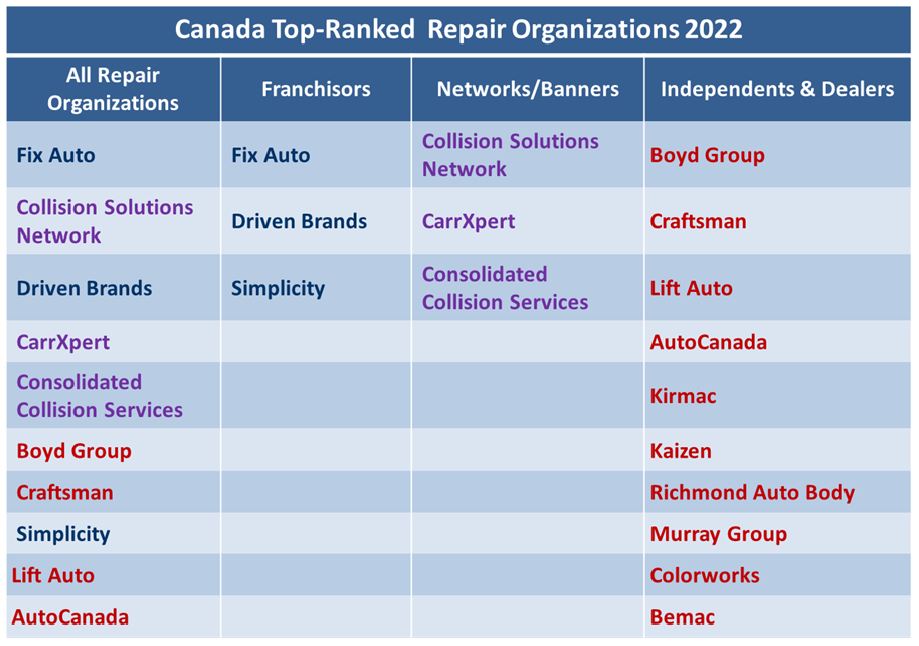

When ranking all the types of repair organizations, the first two positions in the All-Repairers ranking are represented by one Franchisor and one Banner Group. The remaining companies reflect a combination of independent and dealer, banner, and franchise organizations.

Industry Trends

The growing cost and complexity of vehicle repairs, as well as an increase in bad driving habits, are creating ongoing problems for the auto insurers. There were and continue to be several reasons for this unprecedented poor performance.

- Total vehicles miles traveled, as tracked by the St. Louis Fed, have been on the upswing since early 2021 and are now approaching pre-pandemic levels causing a spike in claims.

- More severe accidents due to increased bad driving behavior such as increased speeding, distracted driving, and decreased seat belt use that began during the pandemic.

- According to Cambridge Telematics, there has been a 23 percent surge in distracted driving since 2020 resulting in an estimated 420,000 additional crashes in 2022.

- Not all claims are accident related. According to Allstate, catalytic converter replacements jumped 1,155 percent between 2019 and 2022 nationally and by 6,400 percent in Oregon, Washington, Pennsylvania, and Connecticut.

- Average repair costs skyrocketed due to greater repair complexity, higher inflation-based labour expenses, more parts and higher parts costs coupled with supply chain issues, diagnostic scans and calibrations, and new costly materials such as aluminum and carbon fibre.

The five-year forecast to 2027 has the ≥$20 million segment and the Top 3 Consolidators aggressively growing their businesses while maintaining their significant market share lead over the Franchise Networks and the $10-$19M MLO segments. We expect that by 2027, the Top 3 Consolidators will grow from their 2022 market share of over 22 percent to up to 32 percent.

The annual report, A 2022 Profile of the Evolving U.S. and Canada Collision Repair Marketplace, is now available. The report contains the complete results of Romans Group’s research and analysis for 2022, including over 75 charts and graphs throughout more than 100 pages with historical trends and a future view.

The report can be purchased by contacting Mary Jane Kurowski of The Romans Group LLC at [email protected].