Entitled the Profile of the Evolving U.S. and Canadian Collision Repair Marketplace, this new, comprehensive report presents some interesting findings regarding the sector in both countries.

For the U.S. and Canada, the North American auto physical damage ecosystem, and the entire world, 2020 will forever be seen as a year of significant disruption and structural change with far-reaching economic, social and political implications.

The Romans Group discussed and profiled the ongoing disruption that has been continuous during the last five decades as part of their study on the longitudinal evolution within the collision repair industry and its auto physical damage ecosystem’s multi-segment structural transformation.

U.S. Collision Repair Industry

In 2019, the U.S. collision repair industry market grew 3.8% from 2018. Since 2006, when The Romans Group initiated their projected target addressable market (TAM) analysis—the market size estimates for collision repair grew approximately $8.3 billion with a CAGR of 1.9%. In the near term, they expect the total industry market size to continue to move in a positive direction, with 2020 being an exception due to the COVID-19 pandemic.

Consolidation and MLOs

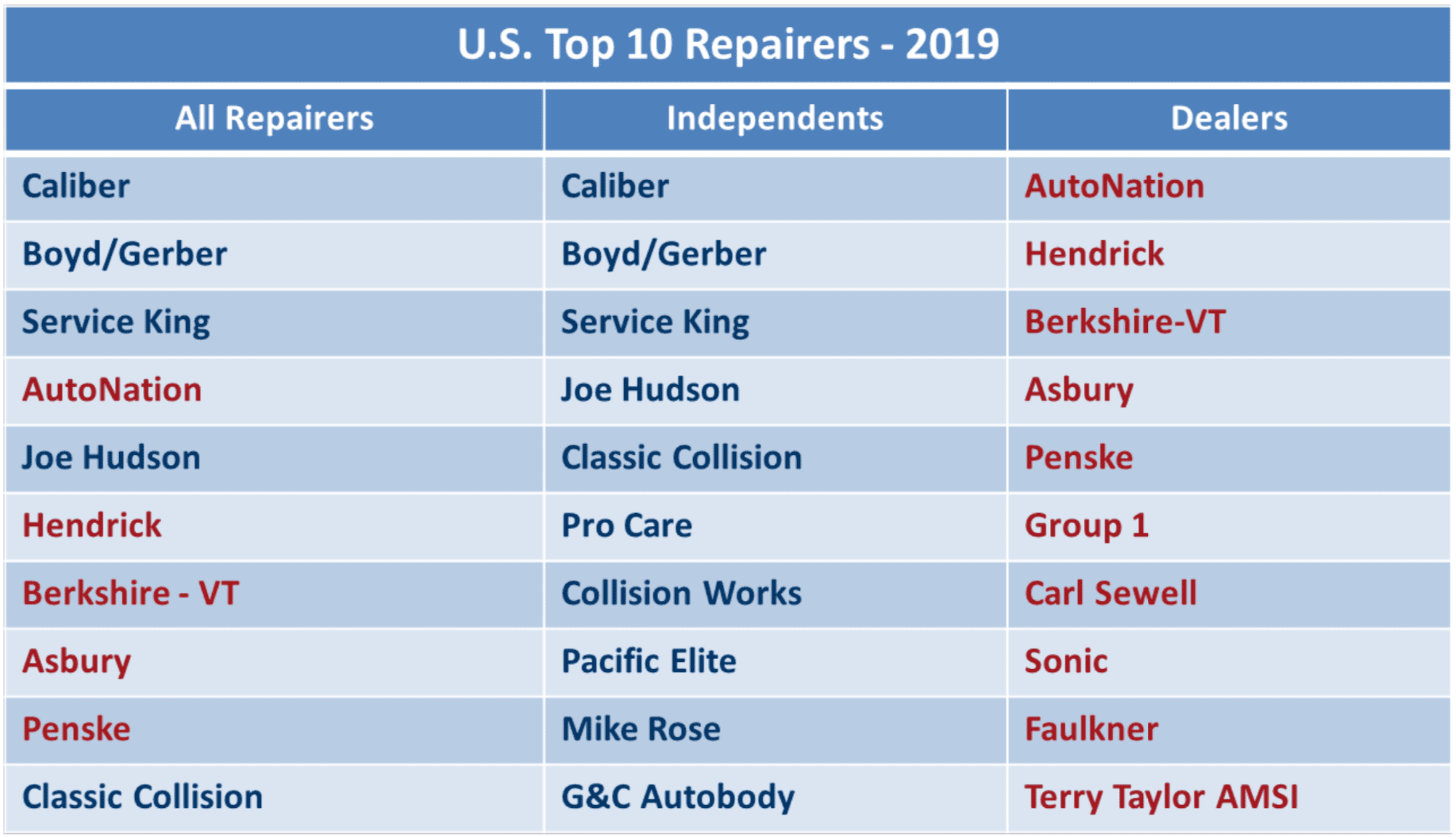

It’s no secret that the collision repair industry has and will continue to experience significant consolidation, reflected in the number of repair locations acquired, along with their respective revenue and transfer of collision repair organization ownership to both strategic and private equity buyers.

The number of repair organizations has decreased considerably since 2000 while consolidators and larger multi-location operators (MLOs) have created multi-location, multi-regional, and national MLOs who now represent 31% of the collision repair industry’s TAM.

There are a total of 14 private equity buyers and 1 strategic acquirer actively investing in the collision repair industry in the U.S. and Canada today. There also continues to be a number of private equity firms reaching out to court small and medium-size MLOs that are interested in partnering with them to grow their business into regional or super-regional MLOs.

Despite these private equity deals and continued MLO acquisitions, there are currently over 70 independent MLOs with ≥$15 million in annual revenue. The Romans Group believes that several of these organizations will likely be acquired by or partner with private equity in the near term.

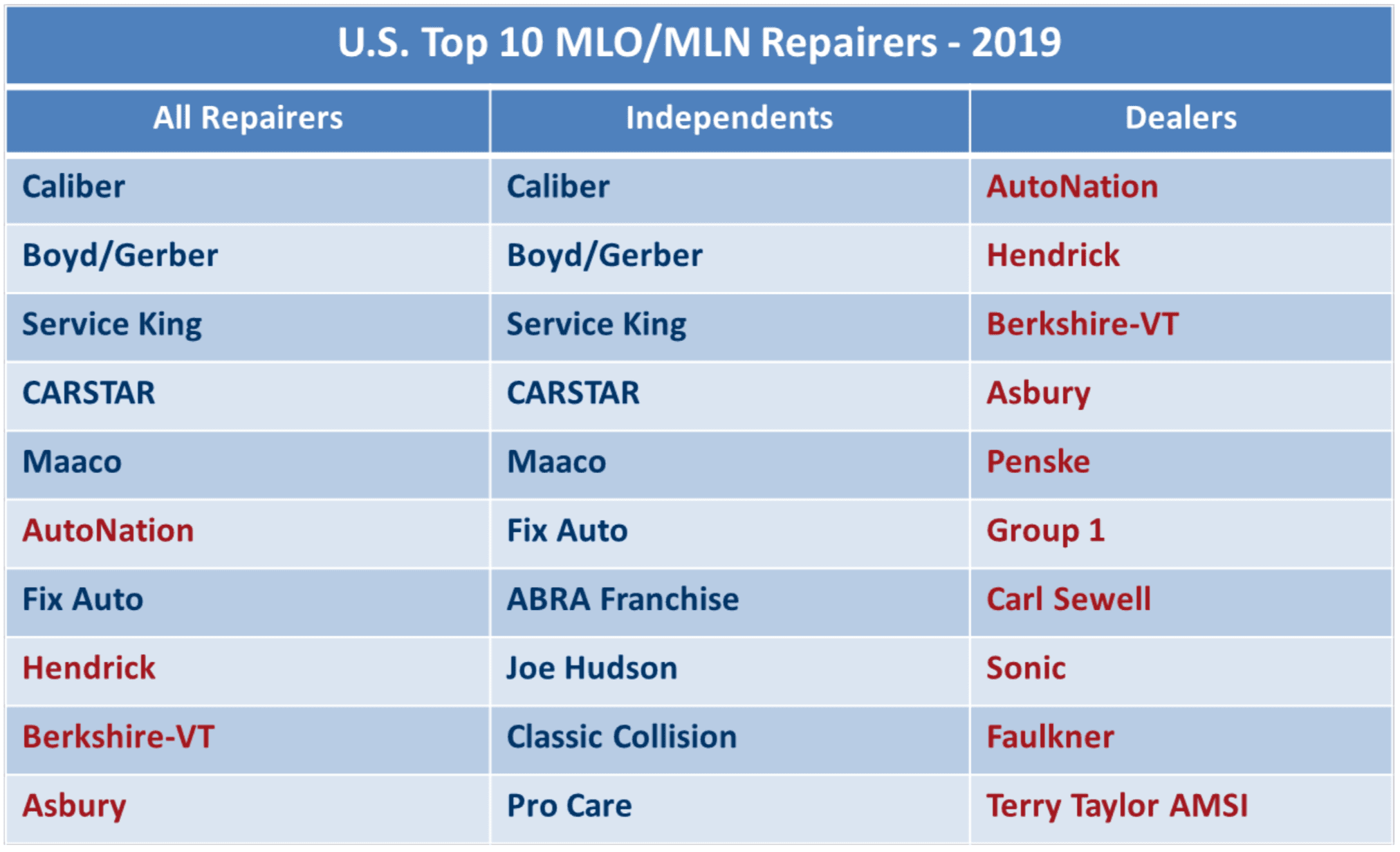

The following chart shows the top ten independent and dealer MLO rankings for 2019.

When they added the multiple location networks (MLNs), to the ranking, they all place within the top ten independents and only ABRA falls out when combined with the dealer group.

Canadian Collision Repair Market

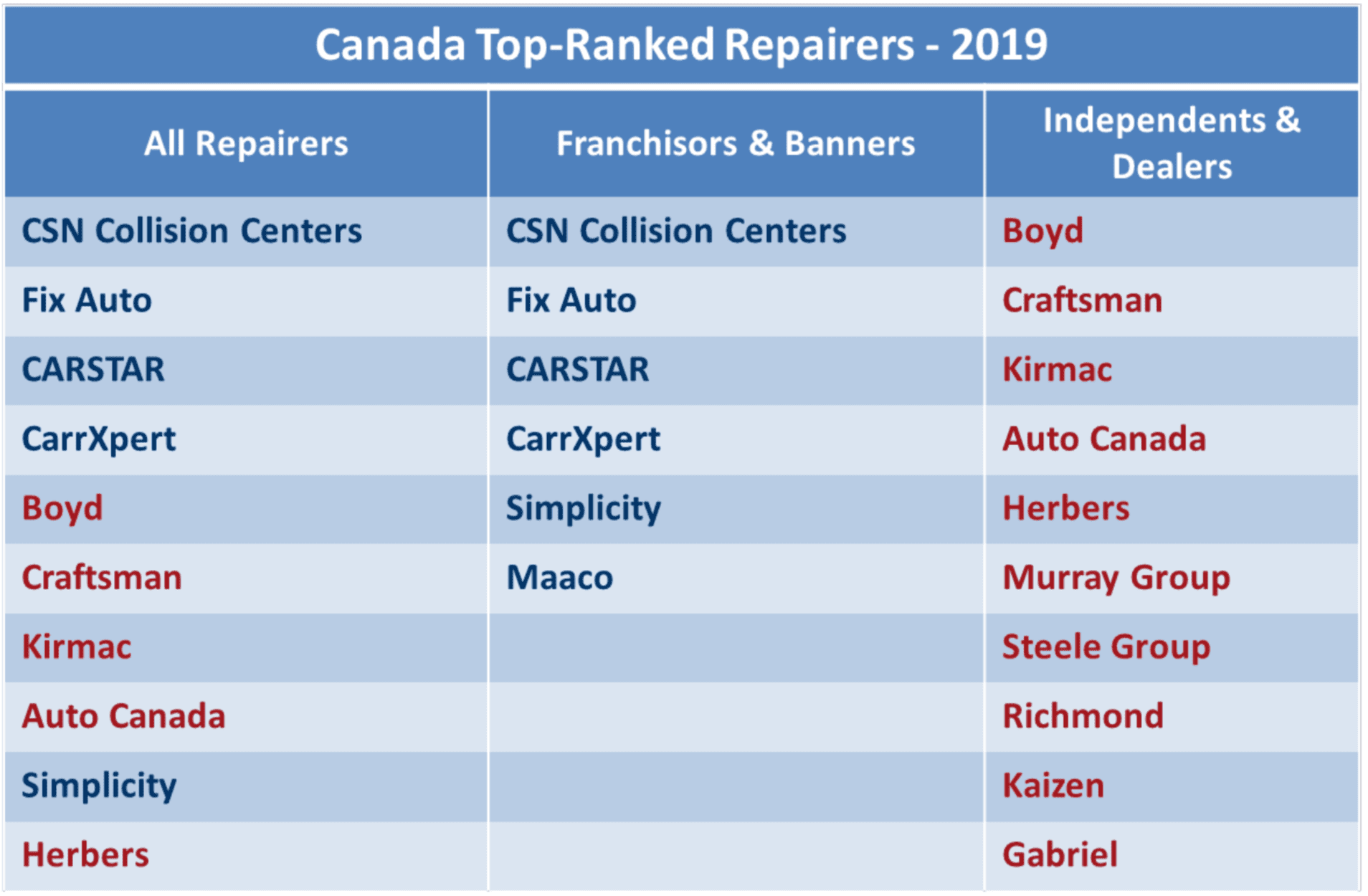

Although the number of collision repair locations in Canada has declined steadily over the past seven years, repair revenue has grown. The Romans Group noted that they do see the combined ≥$10M MLO independent, dealer, banner, franchise network segment revenue continuing to increase at the expense of smaller operators.

The average revenue per location is considerably lower than the U.S., and severity for both repairable and total loss continues to hold steady with an upward trend bias for the immediate future.

The banner organization CSN Collision Centers maintained its first-place ranking within the All Repairers and Franchise and Banners segments. The All Repairers segment Top 10 organizations, which are also represented within the combined ≥$10M MLO independent, dealer, banner, franchise, network segment, represents 76.1% of the industry’s revenue and 31.9% of the industry’s repair facilities.

When comparing the market size and share for the property and casualty insurance auto repair segments for the U.S. and Canada, there remain significant differences in the size of many categories. However, the market dynamics associated with the macro industry constructs presented earlier are very similar in both countries.

The U.S. collision repair market size on a U.S. dollar basis is 13 times the size of the Canadian TAM, with 7 times more repair facilities.

The U.S. and Canadian auto insurance markets are highly consolidated, with the Top 10 private carriers controlling the lion’s share of premiums written and shouldering the majority of claims processed and settled. The U.S. private passenger P&C insurance industry, as well as the auto-only insurance segment, remain much larger in scale than the Canadian market for all other categories.

There are a number of secular trends existing today that will continue to have a material impact and influence on the collision repair industry and within the broader auto physical damage industry segments.

- Insurtech claims processing models reinforce insurers’ preferred business economics

- Private equity’s continued investment, disruption and consolidation influence in collision repair

- Canada-U.S. trans-border market entrance by Collision Solutions Network and ProColor

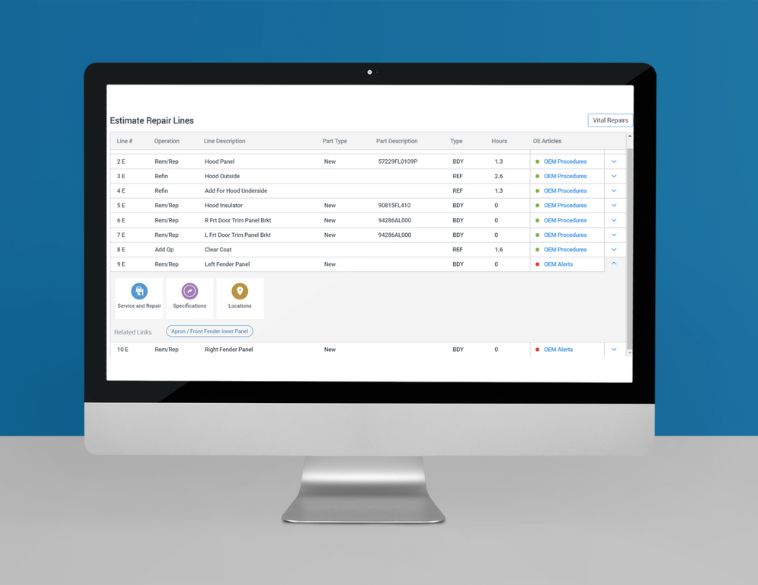

- OEM certification programs’ evolution

- Post-COVID-19 – achieving your escape and landing velocity requires resilient companies and resilient leaders

MONTRÉAL

MONTRÉAL Full time

Full time