What if virtual healthcare helped you recruit new talent more easily while providing added value to those who already work for you?

Think about why your employees should miss a day of work to see a health care professional when they could have access in a few clicks?

Nowadays, consulting a doctor or talking to a healthcare professional on request by videoconference is more than ever possible! Gone are the days when only 34% of Canadians were able to receive evening or weekend care without having to go to the emergency department. Thanks to technological advances, it is possible to offer them this access to a doctor in real-time, via tablet or smartphone. Whether it’s text messaging or video conferencing, your staff and family members could avoid the long queues usually required to see a healthcare professional.

Saving time

Considering that 59% of Canadians find it harder to communicate with doctors in Canada – according to the Commonwealth Fund International Health Policy Survey of adults from 11 countries – just a click away, a secure application could give them access to a nurse. The latter would first perform a virtual sorting while trying to immediately resolve the health problem.

If the state of health of the person consulting requires the expertise of a doctor, he could be taken care of by him via secure video conference. This employee would then have access to a doctor at the appropriate time. This application, now available in quality group benefits plans or individually by piece, saves your staff and their families precious time. Also, it is also profitable from a macroeconomic point of view.

Access to healthcare professionals in real-time

Some telemedicine companies also have “super nurses” who can prescribe medication by sending the prescription to the pharmacy of your choice. Effective! No more long hours wasted trying to deal with sinusitis, hemorrhoids, gastroenteritis, constipation, tendonitis, muscle pain, or simply refilling prescriptions. No longer necessary to wait to receive a consultation request (physiotherapy, massage therapy, tests or diagnostics, MRI, scanner), or settle minor health problems like vaginitis, insomnia, common viruses, nasal congestion, sore stomach, or urinary tract infection. Such an application can also be useful for prescribing vaccines (travel medicine).

As part of a strategy to better understand the needs of millennials and Generation X, telemedicine is an interesting avenue for them. Imagine if your company offered access to a healthcare professional on-demand, 24 hours a day, 7 days a week! You would set yourself apart from your competitors in a context of labour shortage.

Telemedicine is positioned as a powerful and easily accessible prevention tool. The children and spouses of your employees can also access this service at no additional cost. Offering it independently of an insurer becomes an advantage for employees not covered by the benefits plan because they will also be able to access it.

Several criteria must be taken into account, in particular the scope of the service offer, the hours of operation, the quality of the application, the sustainability of the organization, and especially the ability to provide the service in both French and English. One very important aspect to consider: if the chosen provider constantly refers you to clinical or emergency consultations, you will have the opposite effect because people will have the impression of paying for a service like “Info-Health”. So, choose a reputable and reliable firm.

The total cost of such an investment is calculated monthly, according to the number of employees of the organization, and where the use of the service is unlimited.

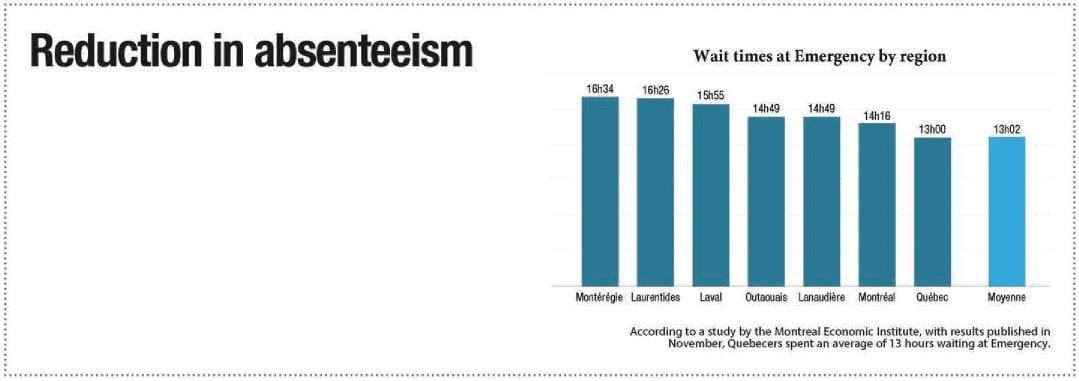

Reduction in absenteeism

Currently, many companies are including virtual healthcare in their group benefits plans. Their experience shows that there are gains to be made by implementing this tool. In addition to reducing absenteeism, affected businesses have noted that it can help reduce the stress levels of employees who previously had to take time off work to care for their sick young children, or due to chronic health problems.

Guy Barbeau is Vice President of Group Benefits and Annuities at WBL Insurance and Actuarial with more than 20 years of experience in financial institutions in both commercial and personal finance. He is a Member of the Board of Directors and National Director of the Credit Institute of Canada and holds an MBA from Athabasca University as well as the CCP professional title.

BROSSARD

BROSSARD Full time

Full time