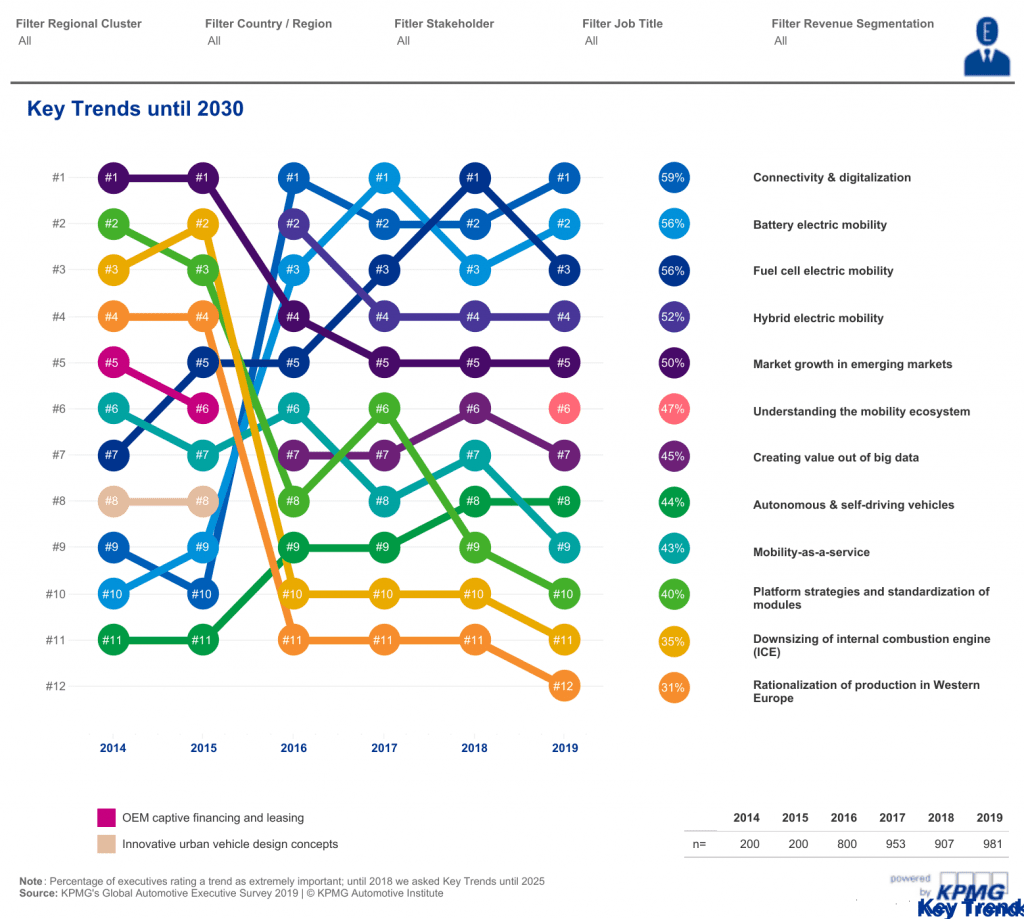

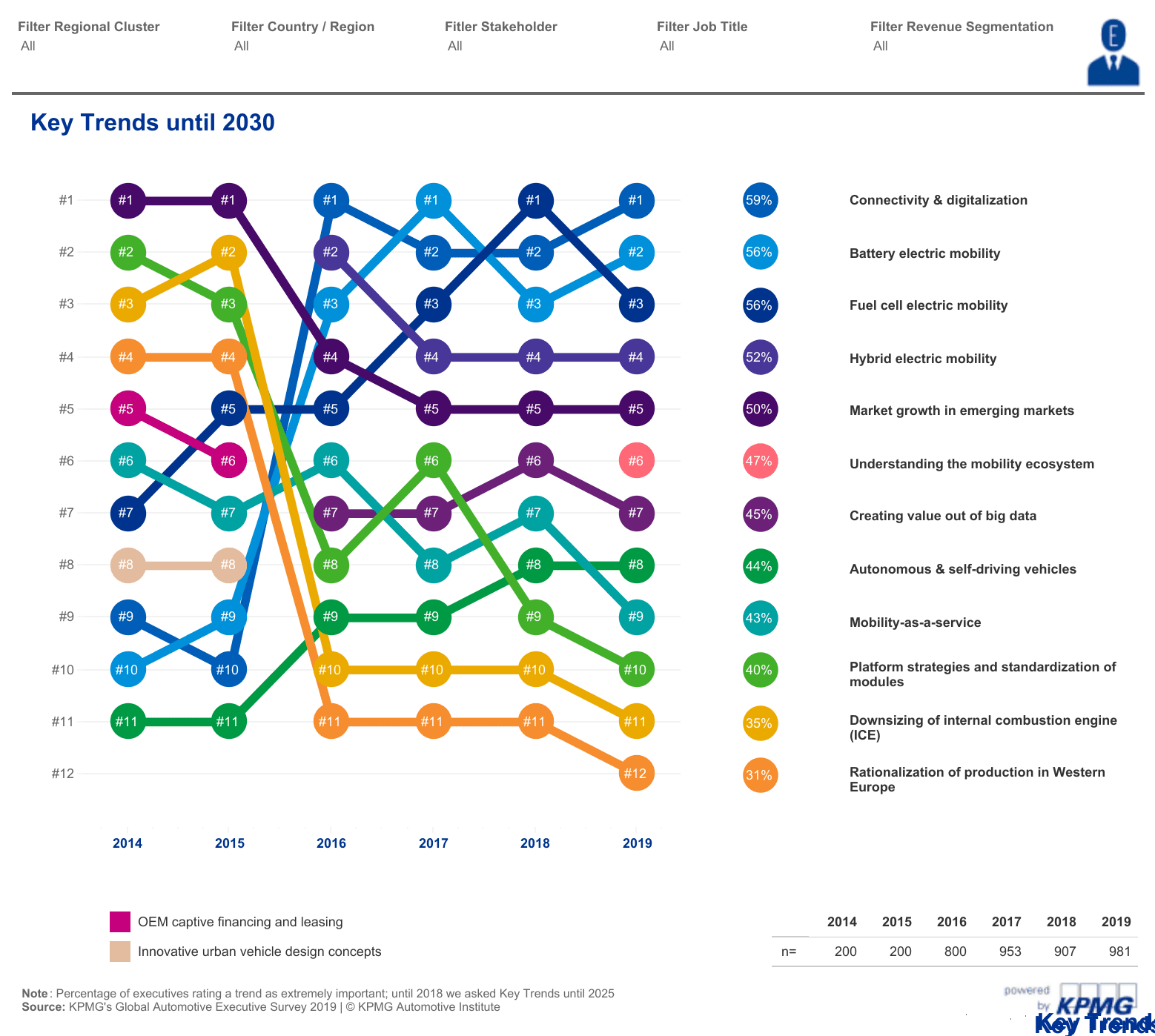

The global auto industry is entering a phase of restructuring, with global auto executives recognizing the importance of connectivity and digitization as the key automotive trend up to 2030.

According to the 20th KPMG Global Automotive Executive Survey (GAES), there will be an expected shift within the industry that will affect auto company profitability and original equipment manufacturers (OEMs) as they will soon encounter tougher market conditions and shrinking global markets.

One of the survey’s key insights includes how profitability will decrease due to hardware and software complexity, new business model development, and regional shift. Statistics show that:

- 67% of executives believing that by 2030 less than 5% of the global car production will originate in Western Europe;

- 60% of executives agree that there will no longer be a differentiation between the transport of humans and goods in the future; and

- More than 3 out of 4 – or about 77% – of executives agree that the regulator will drive OEM agenda and will define it through industry policies and regulations.

Dieter Becker, Global Head of Automotive at KPMG, said:

“The auto industry will need to get comfortable with being uncomfortable during this time of change. There is simply not one global answer, and the industry is currently functioning as a set of connected but distinct islands. These entities will change, merge and transform as the industry embraces the technology revolution. KPMG particularly sees this uncertainty in the area of software-driven business. The majority of OEMs surveyed believe they are capable of managing a superior platform service to offer mobility services. KPMG holds a different opinion, as we believe it will be extremely challenging for traditional asset-based players to occupy and compete with tech giants for the software-driven mobility opportunities.”

A second finding states that these industrial policies will be driven by raw material availability, which outlines the product value and the technology agenda. For example, expect the U.S. to focus on internal combustion engines (ICEs) and fuel-cell electric vehicles (FCEV), while China rules the e-mobility market. Here, the main theories are that:

- There will be separation instead of integration in islands of autonomy. This concept will lead to a future where 71% of executives believe that human-driven and autonomous vehicles will not mix.

- For most consumers, the most significant entry barrier into the electric world is price, followed by charging and range.

- Multiple drivetrain technologies will co-exist alongside each other. Executives around the world believe in a fairly even split of 30% of battery-electric vehicles (BEVs), 25% of hybrids, 23% of FCEVs, and 23% of the ICEs by 2040.

Becker adds that “industry policies in Asia and the US seem to be far more advanced than in Europe: 83% of Chinese executives and 81% of executives in the U.S. believe their country has clear automotive industry policies. In Western Europe, only half of the CEO respondents felt the same” adds Becker.

The third insight discusses the retail landscape and the dramatic transformation it is undergoing. Nearly 50% of executives are highly confident that 30-50% of retail outlets will be reduced or transformed by 2025. Other ideas presented were:

- The greatest potential for function-on-demand features will lie in navigation systems, adaptive cruise control, and power upgrades; and

- The trust for OEMs to own the customer relationship has increased both execs (49%) and customers (42%).

The survey presents a fourth and final key idea. These conceptual changes will ensure no one player masters the value chain alone, with 65% of executives believing that the future lies in cooperation rather than competition.

“One thing is clear: no player will be able to manage it alone. There is awareness among executives, with 83 percent agreeing that with the emergence of what we are calling mobi-listics, companies will need to both re-think their business model and also recognize the need for cooperation to create a mobility ecosystem. The company offering the best customer experience to people and goods will likely own the platform,” explains Becker.

Lastly, KPMG and these global executives have also announced Toyota as the brand positioned for best future success, followed by BMW or Tesla.

To read more insights from the 2019 KPMG Global Automotive Executive Survey and to use the interactive tool to filter by country, respondents, and topics, please visit KPMG’s Automotive Institute Publication Platform.