Good news to end another year, with NAFTA and global markets all in great shape.

Another year is almost over, and with it comes good news to round it out. Looking at the global picture, we’re seeing continued solid gains in October, with vehicle sales rising five percent year over year. And on top of that, we finished November with record sales in all three of the NAFTA countries.

China posted another double-digit increase in October, but what I think is even more important is that employment and overall economic activity gained momentum across most Asian countries. That’s an indication that the global economy is gradually improving.

Here at home, we saw double-digit gains in November in Canada and Mexico. While the rise wasn’t as high in the United States, sales there still exceeded expectations, and they were at a level that suggests we’ll see another record year by the end of 2016. A lot of people were saying we’d seen the peak in the U.S. and it was likely to drop this year, but the economy south of the border is staying strong.

Production schedules are up

When sales rise, so does production. The industry has raised its North American production schedule to a three percent yearover- year gain for the opening months of 2017. That’s a significant acceleration from just a one percent advance in all of 2016.

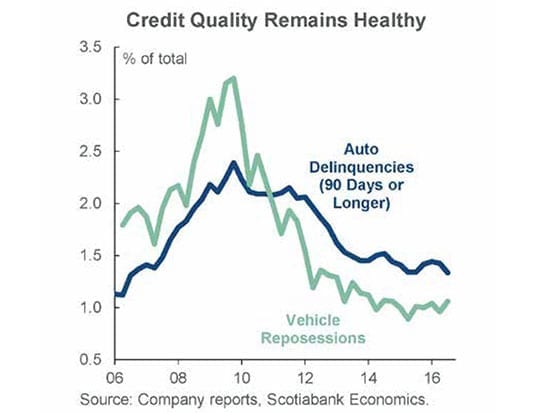

We have seen a couple of things crop up in the U.S. market recently. The level of repossessions there has increased slightly, and there have been some media stories about how subprime auto delinquencies are up as well.

However, when we took a look at auto financing trends in the U.S., we found that the proportion of both new and used vehicles currently financed is at record highs. Back in 2012, about 60 percent of vehicles were financed, whereas now, it’s about two-thirds of all new and used vehicles. This is important because we can expect the number of delinquencies to go up as the number of finance contracts increases.

When you look at the overall auto loans and repossessions relative to the share of vehicles overall, it’s not increasing. If we hadn’t seen the number of financed vehicles rise, we wouldn’t have seen the level of repossessions go up, and so this is not something we’re concerned about.

Few worries over delinquencies

We have also heard people comparing that rise in subprime loan delinquency to what happened with the U.S. housing market a decade ago. However, it’s important to understand that current auto loans only represent about nine percent of overall U.S. household debt. When the housing market peaked, mortgages made up 74 percent of overall debt. That’s why we had the problem that we did, and this is clearly a very different environment. And finally, when you look at auto loans, the subprime ones only account for about 2.5 percent of overall household debt. That’s not significant enough to create problems in the overall debt portfolio.

The good news in Canada is that when you look at auto loan delinquency rates in this country, they have been going down in recent quarters. We had seen an increase from about the middle of 2014 through late 2015, most of it centered in Alberta. However, that has now reversed, which is indicative of improving household conditions overall. That’s important to dealers and to bankers, because it’s telling you the system remains healthy and we’re not seeing any deterioration in economic strength.

The shift to buying new

American buyers are now shifting their focus to new vehicles, which are increasingly financed. Prior to the global economic downturn, used vehicles accounted for 73 percent of overall purchases in the U.S., and during the recession of 2008-2009, they rose to a peak of 77 percent share. But the share of preowned models has fallen to less than 70 percent of overall volumes during the past two years, primarily due to improved credit availability.

Of course there’s still the question of what will happen when President-elect Donald Trump takes the reins in Washington. While anything can happen, some of the people Trump has picked for key economic portfolios do believe in trade, which suggests that NAFTA won’t be scrapped. In one of his first interviews, the nominee for Secretary of Commerce suggested that tariffs against Mexico are a last resort rather than something you start with, so it’s obviously a positive sign. It also looks like the TPP will not go ahead. Obama said that he had hoped to pass it before he left office, but support for that has dwindled, and Trump commented that it’s dead. We’ll have to wait and see until the actual policies are put into place.

To wrap up our year, the global economy is getting better, the U.S. is showing a positive note, and in our home market, our consumers are seeing improvement. Here’s to 2017!