Positive numbers worldwide help cushion any blows.

Individual events may have their effects but, overall, the global picture for the automotive industry remains positive. Worldwide, the global markets continue to improve, including some that seemed almost in free fall not that long ago.

What the results of the U.S. election will ultimately bring is still up in the air. Everyone was fearful on the following morning, but when President-elect Trump gave his acceptance speech, he sounded like more of a statesman than people were expecting.

In the days after the election, the stock markets rallied. Based on his statements so far, people are thinking that his focus will be on attempting to boost infrastructure spending and maybe cut taxes. These are both policies that would help economic growth. The risk is if he does something to attempt to limit trade. We’re hoping that whatever measures he does take will not be too restrictive, but it’s still a highly uncertain environment.

Double-digit sales growth

But all of this is taking place against the backdrop of an improving global picture. In September, the latest month for which we have full data, global sales accelerated to 10 percent year-over-year. That is the fastest gain of the past three years.

It’s a broad-based improvement, and Asia leads the way with sales increases in excess of 21 percent. That’s primarily because of very strong numbers in China, but sales gains are also improving across most of the Asian countries. China’s surge in September, which was 32 percent above the same month last year, marked that country’s fourth consecutive monthly gain in excess of 20 percent. Much of that is because shoppers are rushing to buy new vehicles before the end of the year, when a reduction in sales tax on small vehicles expires.

Volumes were also strong in Western Europe, while in Eastern Europe, sales were positive when looked at year-over-year. Declines continue in Russia, but double-digit advances in eleven countries more than offset the drop in sales there.

Stronger sales than expected

Even in the United States, auto sales in the last couple of months have been stronger than people were expecting. In September and October, you had sales levels that were approaching 18 million units. That’s in contrast to sales in the low 17 million units in the prior eight months. Although one automaker temporarily idled some plants due to a high inventory of some models, the industry overall increased its full-year North American production plan to record highs, prompted by the fact that September’s performance was better than expected.

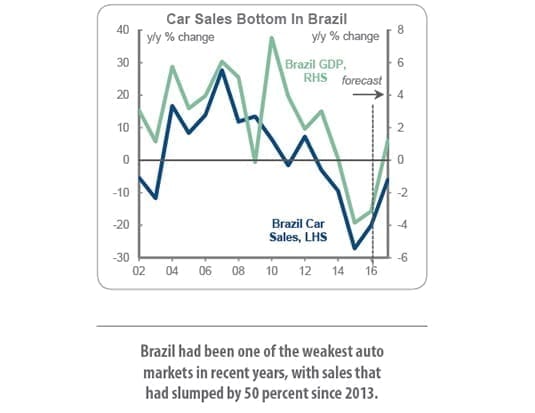

Our “free fall” country was Brazil, and even there, we’re starting to see an upturn. Brazil had been one of the weakest auto markets in recent years, with sales that had slumped by 50 percent since 2013. Sales are not yet rising year-overyear, but a clear bottom has formed. The Central Bank had raised interest rates because of inflation, but it has now cut them and rates are beginning to go down. That gives consumers more opportunity and ability to go out and purchase a new vehicle.

In addition to the sales drop levelling out, Brazil’s vehicle production is ramping up even faster than the improvement in sales, which is largely because of significant increases to neighbouring countries. Two-thirds of Brazil’s auto production goes to Argentina and Mexico, and both of those countries are experiencing double-digit sales gains. We have some data that suggests the auto industry has been boosting its investment significantly in Brazil in the last little while. They’ve been bulking up their facilities and waiting for this upturn in activity. As we start to see the improvements, it’s important to have sufficient capacity in place to meet the growing demand.

Sales bounce back in Canada

In Canada, sales bounced back in September, although overall volumes fell short of last year’s peak. It’s estimated that overall purchases in the month totalled 1.96 million units, well above the 1.89 million average of the past two months, and only marginally below the year-ago record for September. Activity was mixed across the provinces, advancing in five provinces and declining in the other five, compared to September 2015. Ontario and British Columbia continue to outperform, and while fleet volumes are leading the way in both provinces, retail activity is also moving higher.

All of this is more than just “good news.” The reality is that most of the indicators that we track are showing improved strength. That is definitely positive and will help to cushion any kind of downside activity that may happen, whether it’s from the U.S. or another part of the world. So far this year, we’ve seen the Brexit vote for Britain to leave the European Union, and the election of a U.S. president who has suggested policies that could result in trade uncertainty, but we’re proving to be very resilient.

That’s because of the health of the global economy overall. A few years ago we might have seen more fallout from such news. The pace of economic recovery has been sluggish by historical standards, but we’re healthier than many people thought. We keep getting hit with shocks, but we can take these body blows and still remain standing.