Latest research paints a clear picture of today’s buyers, and the vehicles they want most.

Each year Canadian Black Book endeavours to dig into the psyche of Canadian auto consumers, to gain and share insights into how the landscape of car buyers in the country is changing. We conduct this survey annually with the help of our friends at Ipsos, and the results always reveal some very intriguing storylines.

We all know that the business of buying and selling cars is changing. New products, new technologies, new marketing strategies, new consumer demands, new consumer options, new retail models, are all examples of what we are dealing with in the auto sector as every day, month and year goes by.

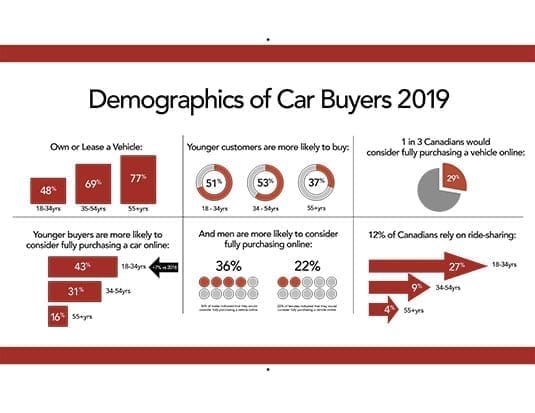

The research we conduct each year allows us to see more clearly how the car buying public thinks and to better understand their experiences and intentions. We dissect this information between demographics, regions, income brackets, and more. Some of this knowledge could be key information into how the industry should prioritize. One thing is for sure—the youngest consumers of vehicles see this market much differently than the “more experienced” generations.

Consumer intent

The first and most obvious form of change that we can expect is consumers’ intentions to change to a new vehicle. In fact, 47% of those surveyed suggest that they intend to buy a vehicle over the next two years, which should be seen as an encouraging number for those who make it a business to sell cars. Perhaps this is the case, as 44% of respondents report their vehicles are five years or older.

To dive a bit deeper into that number, the group of Canadians that are most likely to buy in the next 24 months are those between the ages of 35 and 54, where 53% showed purchase intention. Only 37% of those 55 plus intend to buy in that same period. Of all those who intend to buy, 70% of those with less than high school education intend to buy used, while only 32% of those who are university educated will seek used vehicles. Similarly (and understandably), the intention to buy new increases with the level of household income. Interestingly, 60% of males intend to buy new versus only 52% of females.

Green vehicles

Another change we are seeing is what consumers are willing to buy, which they were not as willing to do in years past. The growing acceptance of alternate energy vehicles is something the entire industry is increasingly embracing. Good thing, because our research suggests that if gas were to increase $0.25 per litre, 48% of Canadian drivers would consider changing to an alternate energy vehicle. Oh, and of those who intend to purchase in the next two years, 53% would consider a non-combustion option.

This trend is more evident in British Columbia where 64% would consider the greener option while the province least likely to accept non-polluters would be Alberta at just 34%, which is still a substantial number. Males are more likely to seek alternate energy vehicles at 58%, while 38% of females would. As you might imagine, younger buyers aged 18 to 34 are the most likely at 58%. As we get older, these numbers begin to decline, and those 35 to 54 are less likely at just under half (48%) of those surveyed in that age range. In my opinion, even the groups that are less likely represent a strong potential for continued increases in the sale of alternate energy vehicles.

Online shopping

So how will shopping, buying and selling change? Well, that answer could be an entire column in itself. But one way, for sure, is online retailing. According to our survey, 29% of car owners in Canada would buy a car fully online. What stuck out to me is that of these people, 46% intend to buy in the next two years. And again it’s the youngest car buyers (18 to 34) that welcome this idea most, as 43% of them are open to buying a vehicle online, versus just 16% of those aged 55 plus.

Car sharing

Another interesting change that we expect to grow is the reliance on car sharing. Currently, 12% of Canadian drivers report relying on ride-sharing services. And once again (do you see a trend here?) youth is driving this number, where we see 27% of the 18 to 34 group sharing rides. Also, with lower household income (under $40k annually) comes higher uptake at just under a quarter of respondents (23%). Regionally, those in British Columbia are most likely to use this type of service (15%), while the three Prairie Provinces are all least likely (9%).

So, where does this leave you? Well, at the very least, this provides some food for thought. And, we might want to start thinking about how we are going to facilitate the changing needs and demands of our younger consumers. Kids these days…