The truth about used car prices may not be as dire as some say.

Almost every new vehicle is eventually going to come back to market as a used one. Many people are worried about that right now, as they look at softening used-car prices in the United States and say it’s indicative of a coming trend of lower vehicle demand overall.

Prices for used vehicles are weakening, but we don’t agree that it’s going to be an issue. This has happened historically in every cycle we’ve been through over the past forty years. It is a sign that we have a large increase in the supply of used vehicles coming into the market, but weakening prices alone do not lead to a slowdown in demand.

Much of the news was tied to a report that the largest auto rental company in the U.S. reported a loss that was much sharper than expected, due to slumping residual values. In conjunction with a rising number of vehicles coming off their leases in that country, many worried that pricing pressure would continue to intensify, and lead to a cyclical downturn.

The eye of the storm

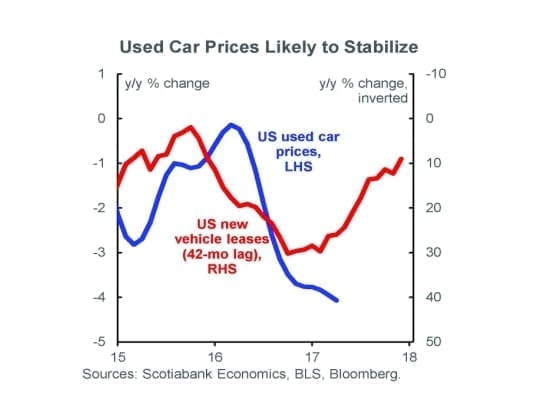

Instead, we consider this the “eye of a used car storm.” We believe the off-lease vehicle growth has peaked, and going forward, the pace of vehicles coming into the market will moderate. Leasing enjoyed its largest growth spurt in 2013 and 2014, but the level of growth has moderated significantly since then.

In 2012, leasing held a 22 per cent share in the U.S. auto market. It then jumped to 27 per cent by the end of 2014, representing an average increase of nearly 2.5 percentage points in 2013 and 2014, which was double the average of the past fifteen years. During this time, the number of leased vehicles in the United States surged by nearly 1.5 million units, or about 60 per cent above the advance of the previous two years.

These vehicles are now coming back on the market, creating a 30 per cent surge year-over-year in off-lease cars. That’s what created the “price scare” that we’re currently seeing.

Moderation is the key

But while leasing continued to increase since that high-water growth mark, the pace fell back to fewer than 400,000 vehicles last year, which is nearly half the advance of several years ago. This moderation will result in significantly slower growth in off-lease vehicles, and less downward pressure on used-car prices.

What’s important to keep in mind, if you are concerned about the trend, is that automotive cycles have historically only ended when there were other external factors at play, such as deteriorating labour markets and softer income trends. Those factors are not present right now. The U.S. labour market remains strong and wage gains are accelerating, while real income growth is above the cycle average. As well, interest rates and credit conditions are favourable, which is inconsistent with a peaking auto market.

The key message here is that while used-vehicle prices are lower than we’ve been used to seeing, economic activity in the U.S. and Canada is actually strengthening.

It’s also important to note that vehicle replacement rates are historically low. More than half of all U.S. households bought a new or used vehicle annually between 1986 and 2006, but since then, the rate of vehicle purchases has slumped to an average of 44 per cent. The U.S. fleet is now at a record age of 11.6 years. The stronger economic growth we’re seeing, combined with this older fleet, suggests that people are still going to be replacing their vehicles, making it unlikely that we’ll see a near-term auto cycle peak.

Stronger economic conditions

Keeping an eye on the replacement rate and auto sales south of the border is important because, as it’s often said, when the United States sneezes, Canada catches a cold. We did see sales weaken on a global scale in April, but we think it was due to the distortions created by a late Easter and the corresponding loss of selling days. Once that’s out of the way, then combined with an environment where economic conditions are getting better, we think the outlook is good.

Here in Canada, we’re also seeing some softer prices on used vehicles, but not to the same degree, as our surge in leasing was not as large as it was in the U.S. during the same period. We’re seeing roughly a 30 per cent year-over-year increase in the number of vehicles coming off lease, which is putting some pressure on prices. But in the latter part of 2017 and into 2018, we expect these numbers to moderate significantly, and fall to about half the pace of what we’re seeing in the U.S. right now.

The key message here is that while used-vehicle prices are lower than we’ve been used to seeing, economic activity in the U.S. and Canada is actually strengthening. Last year’s Canadian GDP growth was fairly weak at just 1.5 per cent, but this year our forecast is for 2.5 per cent, and that will outperform what we are expecting for the U.S.

We have never had an auto cycle peak that wasn’t accompanied by weak overall economic conditions, and we’re not seeing that situation. The annualized selling rate is still above last year’s record, and the Prairie provinces are coming back economically. When it comes to prices and peaks, don’t believe the rumours.