Canadian auto lenders aim to deliver highly tailored solutions to auto buyers and dealer challenges.

J.D. Power’s 2017 Canadian Dealer Financing Satisfaction Study finds that dealers are most satisfied with their lenders when they are assigned a dedicated primary buyer or buying team.

“In the current marketplace, the difference between closing a deal and losing a customer to the dealership down the street will frequently be determined by the finance department’s ability to secure the right loan at the right price,” said Jim Houston, Senior Director of Automotive Finance at J.D. Power. “The more adept these financial professionals are at helping dealers address specific challenges along the way, the more business they will ultimately do with that dealer.”

The study also found that dealers who have the highest levels of satisfaction with particular lenders are those who have a primary buyer, or buying team, assigned specifically to their dealerships.

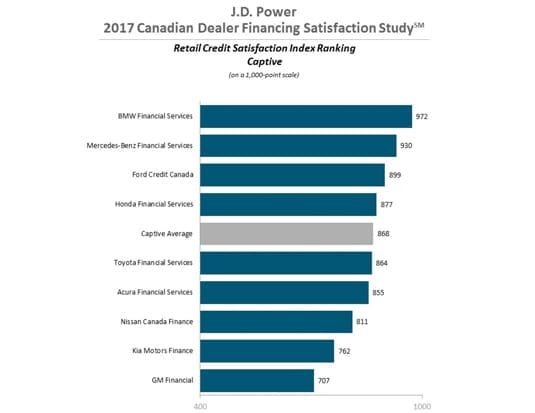

In terms of lender rankings, the study found that BMW Financial Services ranks highest in the captive lender segment, followed by Mercedes-Benz Financial Services, Ford Credit Canada, and Honda Financial Services, in the top four spots.

Among non-captive lenders, Bank of Montreal ranks highest, followed by Scotia Dealer Advantage, TD Auto Finance, and Scotiabank.