Although there’s no need for panic, you should be paying more than the usual attention to used car prices and residual values.

Life has been vibrant for the auto industry in recent years. Canada set a record for new car sales in 2015. As for 2016, it was off to a very strong start but has softened of late. Will we make a new all-time record? If so, I think it will be by the slimmest of margins. Used car sales have also been stronger than ever before. According to Statistics Canada, this past February saw record used car sales. Residual values have been very solid, especially for trucks where we’ve seen around 57 percent retained value for four-year-old trucks, which is truly impressive.

Back to basics

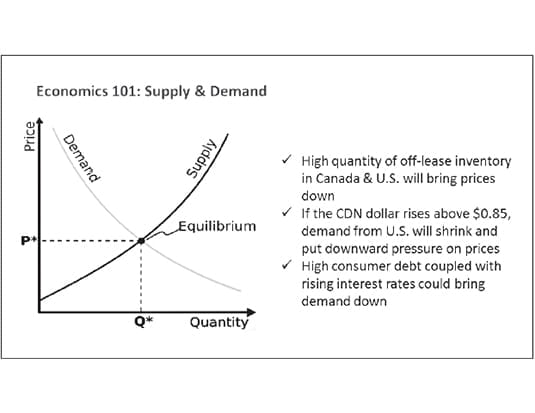

With that glowing preamble, I’m sure you’re expecting a “but” to emerge. Before we get to that, I must briefly remind everyone of a fundamental principle of economic theory–the laws of supply and demand.

What we do at Canadian Black Book for residual value forecasting and used vehicle valuation relates directly to the movement of supply and demand, and the decay of depreciation. If there exists excess supply of an item, the price falls. If there is scarcity, the price goes up. If there is an item in high demand the price rises, versus an item that consumers are less interested in, in which case the price falls.

There are a number of characteristics in the auto industry today that I consider to be risk factors. I feel these will contribute to significant decrease in used vehicle prices, and residual values, over the next two to three years. Depending on the segment, this adjustment could be in the range of 10 to 15 percent and perhaps much more.

Off-lease vehicles

Lease penetration has steadily been climbing since leasing imploded in late 2008. Today (according to J.D. Power) it hovers around 26 percent, double what it was in 2010. Typically this is good news for the used car business; off-lease vehicles make great used cars.

The challenge is that the supply coming back off lease is rapidly increasing, faster than the market can naturally absorb. I expect this increase to create 60 percent more off-lease vehicles between now and 2020. Will this be good for prices? No, prices will fall. Remember, supply and demand?

Furthermore, consider that south of the border an even bigger challenge exists with 800,000 more vehicles annually coming off lease in the next few years. With booming U.S. off-lease supply, prices will fall, softening some of the Canada-to-USA vehicle exports that have been propping up prices here at home.

A challenging exchange rate

Speaking of the U.S., another key character in our story is the exchange rate. The weaker Loonie has set vehicle prices here in Canada as bargains at U.S. auctions. It’s not unusual for a U.S. buyer to make an extra $4,000 profit on a truck sourced here in Canada.

What the dollar will do in the future is hard to say, but once it rises above $0.85, the incentive to export vehicles will vaporize. This lack of demand for Canadian vehicles will put downward pressure on prices here at auction.

This story of supply, demand and downward pressure on prices isn’t all about the influence of the U.S. market. The current trend towards extended term loans for 84 and 96 months, resulting in so many buyers being in positions of negative equity, are not helpful.

When interest rates rise, many consumers may have difficulties with affordability of their next vehicle purchase, particularly when you consider the recent Statistics Canada report that shows record high levels of consumer debt.

We owe more than $1.60 for every dollar we make. This suggests the auto market could see some form of demand correction when consumers begin purchasing less, either by deferring a purchase or buying a more affordable car. Less demand equals lower prices.

A need for caution

So, where does this gloomy story of supply and demand leave us? First and foremost, for those who manage residual value risk you should do so with a heightened degree of caution. The next 24 to36 months will not experience booming prices and a seller’s market for used vehicles. Plan for at least a 10 to 15 percent drop in the next 36 months, perhaps more.

Seek professional help. If you’re in the leasing business make sure you obtain residual value forecasts from more than one source, like getting a second opinion on a serious symptom.

As rain clouds approach, an effective remarketing plan for off-lease vehicles has never been more important. For OEMs, a well-managed (and well-funded!) CPO program is critical to divert cars from open auction.

For new car incentive managers, your mighty budgets will buy less than they once did. With residual values falling, leasing will become more costly and less attractive. The elevated costs of leasing may shift consumers back to finance.

The sky is not falling in general. Many economic indicators are strong, so don’t despair. However, used car prices and residual values are a different story. How much they fall will depend on how these risk factors feed off of each other. Remember, it’s all about supply and demand.