Despite world politics, the auto industry is strong, and record production is scheduled for this summer.

Once again, despite the headlines that we see in the newspapers on the state of world affairs, there’s a positive note to the auto industry. Vehicle sales slipped slightly in Canada in July, but global sales have posted solid advances over the summer, continuing a string of strong gains that started back last September.

In late June we had the Brexit referendum, which created a fear that we were going to be plunged into an environment of slower economic growth, not just in the United Kingdom but potentially around the world. That’s not entirely without cause, as the U.K. economy is softening and the Bank of England cut rates, but globally, it doesn’t look like the disaster that many people were expecting. When we looked at the global auto sales numbers, they were actually strengthening in the face of that fear.

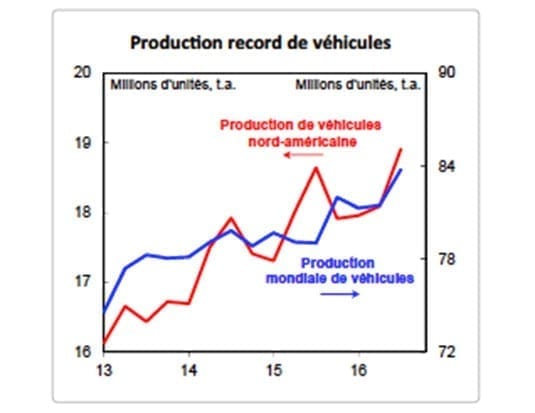

In fact, we expect global vehicle production to move higher across most of the world in the second half of 2016. That will be led by North America, where the production scheduled for the period of July to September will, if it follows through, mark a record for third-quarter vehicle assembly.

Shorter shutdowns mean more vehicles

Much of that is due to schedule changes. Two of the three Detroit automakers are shortening their summer shutdowns across North America, with eight assembly plants in Canada, Mexico and the United States having their traditional summer closures shortened to just one week. Five other facilities have plans to operate non-stop throughout the summer.

They need to build more vehicles because dealer inventories came back to normal at the end of May. In the U.S., dealer inventory stood at 61 days, while the industry norm is generally considered to be 65 days. Earlier this year, we’d seen inventories as high as 79 days.

That rising vehicle production will now start to add to GDP growth across North America, and in particular, the increase from the auto sector in the U.S. would be the largest in more than a year. And even though we did see vehicle sales soften a little in July, most Canadian auto production goes to the United States. That country’s vehicle sales climbed to their highest level in eight months, and since U.S. sales generally dictate much of Canada’s production, that’s very positive for our auto manufacturing sector. In Ontario, the auto sector accounts for more than 40 percent of that province’s manufacturing exports. And, of course, those record sales tell you that the American consumer is still in very good shape.

In the United States, auto assembly is scheduled to climb to an annualized 12.8 million units in the third quarter of 2016. That’s the highest since the start of the millennium, and 4 percent above the full-year production of 12.3 million vehicles that we saw in 2015. This rising output is expected to add half of a percentage point to economic growth in the United States in the third quarter of 2016, the largest increase in more than a year and a sharp reversal of the estimated 0.4 percentage point subtraction in recent quarters.

Consumers love light trucks

The U.S. climb has been driven entirely by light trucks, which also highlights the impact that the sharp decline in oil prices has had on household vehicle buying patterns. There’s been a dramatic shift in preference to crossover utility vehicles, and through May, sales of light trucks in the U.S. and Canada rose by nine percent year-over-year, compared to a slump of eight percent year-over-year for car purchases.

Mexico will also see an increase in its vehicle production, with an estimated jump of five percent year over- year in the third quarter of 2016. This is primarily due to the opening of a new facility in Nuevo Leon, and the restart of an assembly plant in Toluca that was idled during extensive retooling.

Overall, across the three North American countries, we estimate that the annualized production rate will climb to 18.9 million over the summer, up from 17.9 million between January and May.

Strength in Europe and Asia

On the other side of the pond, plants in Germany and Spain saw their orders for new vehicles jump to their highest levels in five years. It will buoy overall economic activity across Western Europe in the coming months, but in light of the moderation of other industries, there is some concern that this impressive rebound won’t be sustainable.

Asia is also heading toward increased vehicle output. China’s sales have outpaced its production gains this year, and automakers reduced their inventory to only 1.4 months’ worth at the end of May, down from 1.7 months a year ago, and from a peak of nearly two months in early 2015. Dealer networks have also been increasing across Western and Northern China, and vehicle pricing has stayed stable since the beginning of the year. Thailand is also experiencing a rebound in its manufacturing, rising 25 percent year-over-year in May, the largest increase in more than two years. Meanwhile, Indonesia, India, and even Russia are seeing either increases or at least stabilization.

In short, despite some global political uncertainty, we’re seeing a good-news story overall.